In a wildly popular 2015 study, McKinsey made a case for bringing on more diversity at work.

It said diversity at the workplace could bring in more financial returns and innovation. Diversifying workforce has always been a consideration for employers. But with the study, the world has gradually begun looking at it as an investment instead–particularly when it comes to hiring more women.

The change has come slow, though. That our workforces are still dominated by men in numbers is telling of how much we’ve adopted it. But it strikes even more prominently for the insurance and financial services industry. With women accounting for barely 30%* of the insurance workforce globally, it’s a not just a social loss, but also an economic one for the industry.

At Vymo, we’re working with 60+ organisations and 150,000+ sales reps in the insurance and financial services sector. We compared the male-to-female performance for 6 months to discover some key findings.

Women consistently outperformed their male counterparts

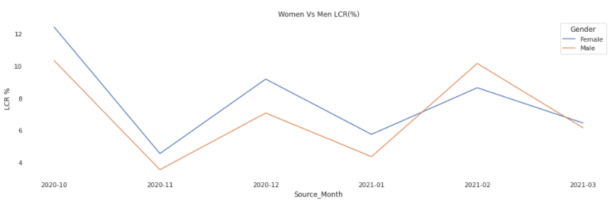

With the first hypothesis, our intention was to understand performance. We looked at the one key metric that most effectively captures the essence of performance in industry: lead conversion ratio. So how did women fare on their performance?

Taking women’s performance on lead conversion, the last 6 Months data shows that women are performed better than men on an average.

Better female ratio have generally indicated better performance

But was that enough to make a case? We dug deeper to understand how the inclusion of more women in the workplace affected general performance of the areas. We split data into different geographical zones and compared lead conversion ratios to that of women:male ratios.

A general trend across zones we observed showcased that zones with better women-to-male ratios ended up performing better. Here’s a snapshot of one such case: Zone 1 has the best Women Ratio, and you guessed it right, it also has by far the best performance.

Higher productivity at lower cost?

Sure, it seems like having women on board is a good idea for performance. But could there be more? We dug deeper to understand what experience-level of women were creating more impact.

By far the majority of Female staff is 20-30 years old, whereas the majority of Male staff is 30-40 years old. Less tenured female workforce is more effective than higher compensation bracket males (more tenured male workforce)

But, we may not be doing enough

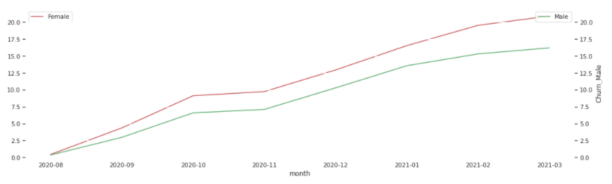

A worrying trend emerged in our study–more women are leaving the workforce than men.

In the six months of data observed, while the general rate of attrition increased, it was more prominent for women than men. The difference in women leaving was almost 25% more than their male counterparts. While there needs to be a deeper dive into how pandemic-driven this could be, there’s definitely a need to look at working conditions offered.

In conclusion: having more women seems to be a better performance-based revenue decision for insurance management.

While causation isn’t correlation, management in insurance should definitely consider the economic upside of employing more female workforce. Not just can it help with sales and revenue, but will also impact innovation and distribution in the longer term.

How does your firm perform on the gender parity scale?

This story was the first of the complete story.

*average number drawn across geographies and institutes of the world based on Vymo data