For insurance leaders, the mandate is clear: grow premiums, control expense ratios, and simplify the tech stack. Vymo’s EngageIQ enables all three by unifying sales execution, coaching, and performance analytics on a single platform by eliminating fragmented point solutions that inflate costs and slow decision-making.

By consolidating sales performance management software and software sales CRM capabilities into one system, insurance leaders gain end-to-end visibility while materially lowering operational costs.

In this blog, you’ll learn how EngageIQ simplifies operations, empowers producers with AI, and equips leaders with real-time insights to drive premiums and improve persistency.

How EngageIQ Simplifies Sales, Coaching, and Analytics

Running multiple tools for lead management, field execution, coaching, and analytics creates data silos, integration overhead, and license sprawl. EngageIQ replaces that complexity with a unified, mobile-first platform designed for insurance sales. The impact:

- Reduced total cost of ownership by consolidating licenses and integrations

- Fewer manual reconciliations and IT support tickets

- Faster time-to-insight for leadership decisions

- Consistent data model across products, channels, and markets

This consolidation gives insurance leaders cleaner forecasting inputs and lets IT leaders standardize on a scalable architecture that supports both captive and independent distribution with common governance.

AI That Removes Busywork and Elevates Producers

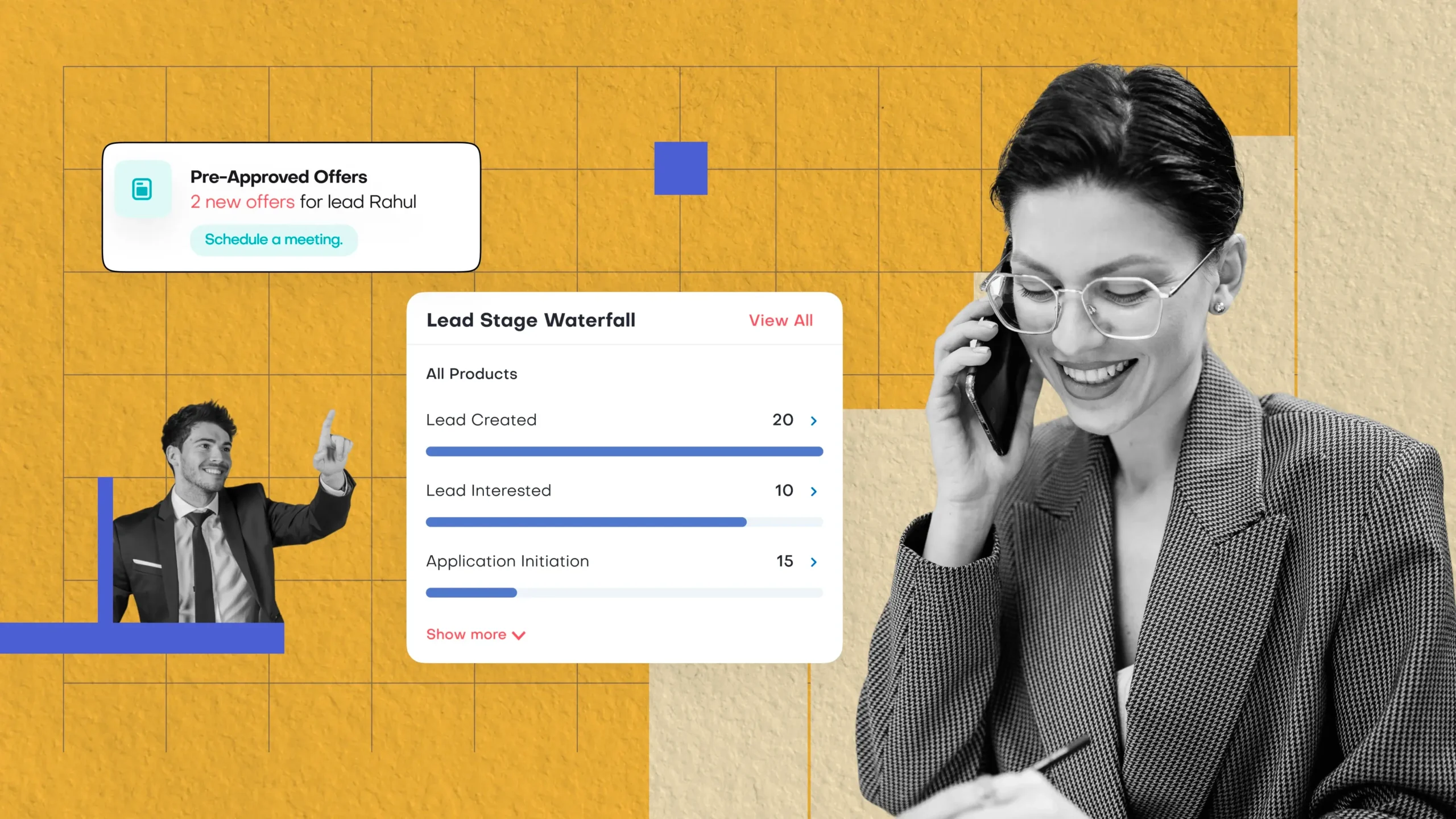

EngageIQ’s AI turns mundane tasks into automated workflows so producers can spend more time solving complex sales problems:

- Conversational AI for voice and text captures meeting notes, updates opportunities, and schedules follow-ups

- Auto-prioritization surfaces the right leads and policies at the right time (renewals, cross-sell, lapse risk)

- Intelligent nudges suggest next best actions to move deals forward

- Automated activity logging removes admin drag, improving data completeness without user effort

The result is higher producer productivity, better conversion on high-intent leads, and more time spent on underwriting nuances, multi-line proposals, and complex commercial accounts.

Real-Time Dashboards That Drive Insurance Sales Decisions

In a margin-tight market, insurance business heads need instant, actionable visibility to drive premium and cut waste. Vymo’s EngageIQ delivers a unified command center with real-time dashboards.

- Activity, productivity, and revenue views reveal what’s working and what’s not.

- Lead and deal insights pinpoint where producers stall—and highlight the actions that win.

- Targeted interventions help turn underperformance around with data-backed coaching.

- Recruitment and retention views close coverage gaps before they impact growth.

- Full distribution control standardizes execution across captive and independent channels.

The result is faster pipeline velocity, stronger persistency, and smarter capital, quota, and territory decisions based on live operating data, not lagging reports.

Built for Insurance Sales Performance

EngageIQ aligns tightly with the realities of North American insurance:

- Supports new business and in-force management with persistence workflows

- Drives cross-sell and upsell across P&C, Life, and Specialty lines

- Orchestrates compliance-friendly engagement, documentation, and approval trails

- Normalizes performance data across GA/IMO structures and agency hierarchies

Leaders gain precise visibility into pipeline quality, cycle time, hit ratios, and persistency so capital, quota, and territory decisions are anchored in live operating data.

Why the C-Suite Chooses EngageIQ

EngageIQ creates measurable value across the executive table:

● CFO: Lower operating costs via platform consolidation; sharper revenue forecasting and persistence visibility; faster payback through productivity lift.

● CTO: Fewer systems to integrate and maintain; standardized data governance; scalable mobile-first architecture.

● VPs of Sales/Distribution: Real-time control over funnel health, territory coverage, and coaching impact; clear attribution for what drives wins.ating data.

Final Thoughts

EngageIQ gives insurance leaders what matters most: a single, real-time view of performance, clear levers to improve producer outcomes, and tighter control over distribution without the cost and confusion of a fragmented tech stack.

By automating routine work with AI voice and text, it frees producers to focus on complex, high‑value selling that lifts conversion, persistence, and premium growth.

Ready to unify your sales stack and accelerate performance?

Book your personalized demo with the Vymo team today and see how leading insurers are getting ahead—one smart step at a time.