In a time of swift technological advancement, the insurance sector is going through a dramatic change. For many years, in-person contacts, personal networks, and manual processes were the mainstays of insurance sales. The tide has shifted today. The digital-first strategy is now a corporate need rather than a passing fad.

For enterprise insurance leaders across the United States, embracing digital-first strategies isn’t just about keeping pace with innovation—it’s about staying relevant, competitive, and prepared for the future of distribution.

The Shift in Buyer Behavior

The modern insurance buyer—whether an individual policyholder or a corporate client—expects the same seamless digital experiences they receive from consumer tech giants. From researching policies online to completing applications in minutes, customers demand speed, transparency, and convenience.

A recent Accenture study found that over 50% of policyholders prefer digital channels for purchasing insurance, and that number continues to rise among younger demographics. If your sales process still hinges on traditional methods, you’re likely leaving market share—and loyalty—on the table.

Data: The New Sales Currency

Data is reshaping how sales teams operate. Digital-first insurance organizations are leveraging real-time behavioral data, CRM analytics, and predictive modeling to tailor their outreach, prioritize leads, and enhance agent productivity.

Rather than relying on intuition or outdated customer records, sales leaders can now arm their field force with actionable insights. For instance, an agent can receive a prompt to follow up with a prospect who recently visited a pricing page or opened an email—turning passive interest into active engagement.

Data doesn’t just enhance sales—it transforms it.

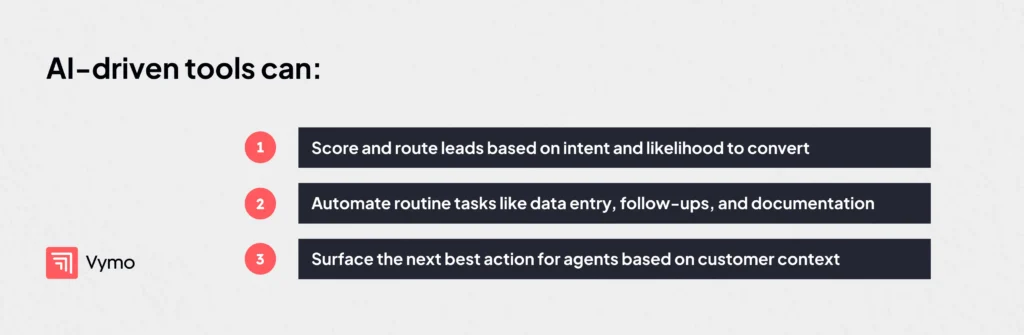

The Role of AI and Automation

Artificial intelligence (AI) and automation are becoming foundational to digital-first insurance sales strategies.

Empowering a Distributed Workforce

The traditional insurance sales force is widely distributed, often working across states and time zones. A digital-first model empowers agents with mobile tools and cloud-based platforms that let them sell, engage, and close from anywhere.

Top insurers are investing in mobile CRMs, virtual training, and real-time collaboration tools that make it easier for agents to stay productive and connected—regardless of their location.

How Vymo is Redefining the Future of Insurance Sales

At Vymo, we partner with leading insurance enterprises across the U.S. to power their transition into a digital-first future. Here’s how we’re helping redefine insurance sales:

- Intelligent Activity Capture: Automatically captures agent activities across calls, meetings, and emails—so no data is missed, and no lead goes cold.

- Next Best Action Recommendations: Leverages AI to guide agents with context-driven nudges, ensuring timely and relevant customer engagement.

- Mobile-First Interface: Designed for the field force, Vymo’s intuitive mobile app empowers agents to manage their pipeline and activities on-the-go.

- Performance Coaching at Scale: Helps managers deliver personalized, data-backed coaching that boosts productivity across the board.

- Integrated Ecosystem: Seamlessly integrates with existing CRMs, policy management systems, and marketing platforms—maximizing your tech stack’s ROI.

The future of insurance sales is proactive, intelligent, and mobile—and it’s happening now.

Ready to future-proof your sales force?

Vymo is already helping insurers unlock 3x productivity, 30% higher lead conversion, and faster time-to-sale.

Book your personalized demo with the Vymo team today and see how leading insurers are getting ahead—one smart step at a time.