Explore how AI sales engagement platforms are transforming insurance producers’ daily workflows in 2026—boosting productivity, focus, and premium growth.

Category: Blog

/- All Posts

- Blog

- Press Release

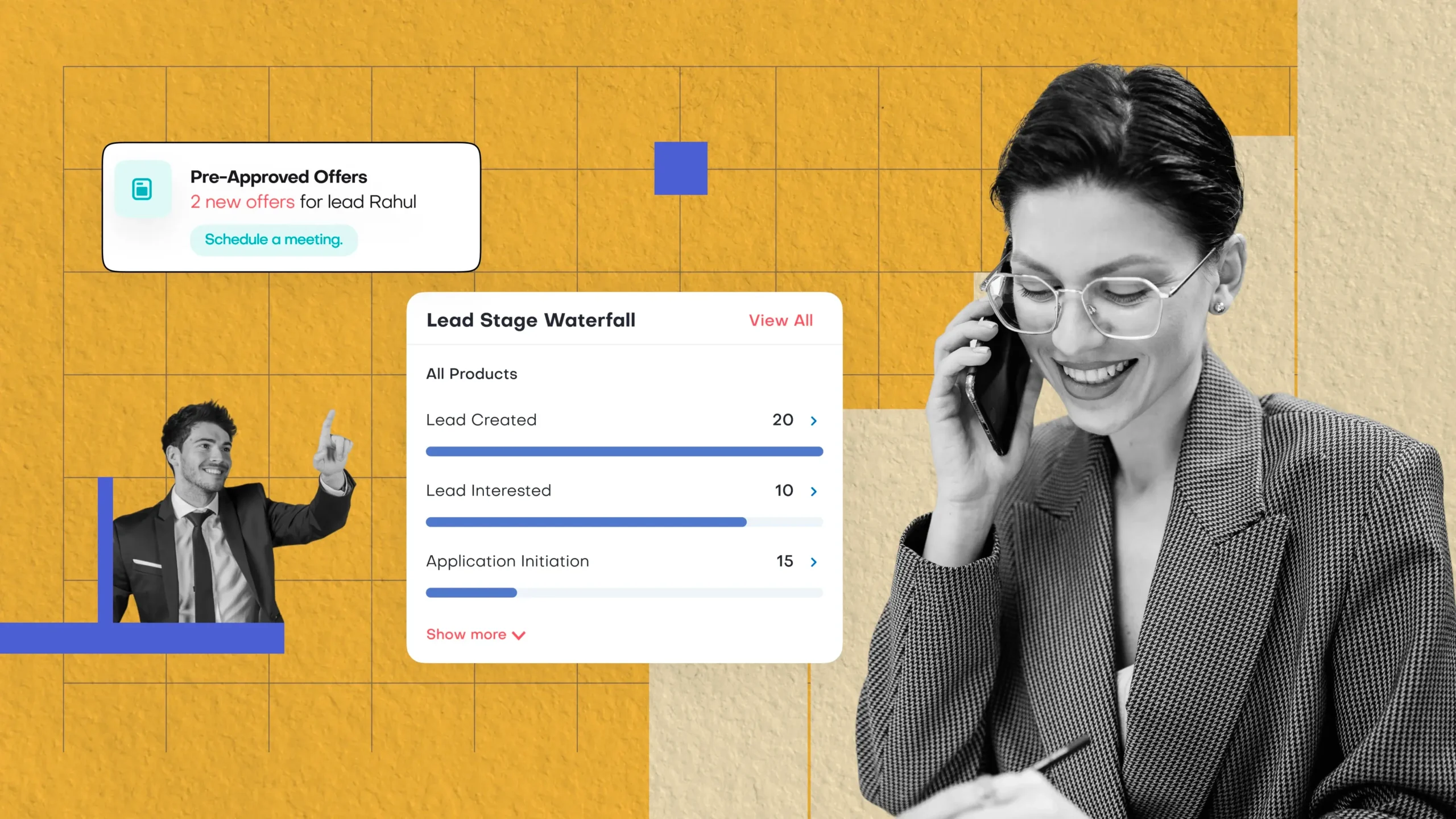

Explore the 5 best lead management software for insurance teams in 2026. Compare tools built to boost agent productivity, automate…

Explore what an insurance CRM is—its features, benefits & more. See how Vymo’s AI-powered CRM helps insurance teams boost productivity…

Learn what sales activity tracking is, why it matters, what to track, and how to get started with an AI-powered…

Learn what sales activity tracking is, why it matters, what to track, and how to get started with an AI-powered…

Discover what AI in insurance means, its core applications, industry-specific applications, benefits, and challenges driving digital transformation in the insurance…

Learn what AI-powered CRM is, how it works, and why business needs it to improve efficiency, personalize service, and drive…

Boost insurance agent productivity with these proven strategies, from automating tasks to real-time coaching and mobile-first sales enablement.

Discover how AI-powered onboarding with Vymo OnboardIQ helps insurance carriers and agencies reduce time-to-productivity, improve compliance, and scale faster.