For financial institutions to be in the limelight, banks and insurance firms need to keep their customers engaged as much as possible. Beyond this, setting the relevant context and pitching the right product in the right manner and at the right time is key in customer relationship management. The better these relationships, the more customers you will see in your client base. To make your customers come back to you, you need to gain their confidence, guarantee their satisfaction, and make them trust your products. The aggregation of prospects from diverse sources and their subsequent nurturing and engagement have emerged as critical components for informed decision-making, building strategic growth and improving customer satisfaction. In acknowledging the challenges faced by financial institutions in managing and nurturing prospects effectively, this article seeks to delve into the synergies between prospect aggregation and nurturing, shedding light on how Vymo is contributing to reshaping client engagement within the financial sector.

Read More: What is Sales Incentive Plan

To gain a deeper understanding of the dynamics of prospect management, Vymo often initiates conversations with clients, posing pivotal thought-provoking questions designed not only to grasp the intricacies of their current deployment but also to prompt a shift in perspective when it comes to selecting vendors or tools for digitizing or upgrading processes. A few of these questions, with respect to prospecting, are given below :

1.How do you handle large volumes of prospects flowing daily into your system?

The inflow of tens of millions of prospects daily presents a significant challenge for financial institutions. Prospects can either be sourced centrally by the lender/ insurance carrier or individually by sales agents, relationship managers or direct sales teams (DSTs). They can be sources from multiple channels such as lead magnets on websites and social media handles, bulk uploading of csv files, agent microsites and more.

Vymo addresses this complexity by automating prospect flows. It smoothly directs centrally-sourced prospects through its intelligent scoring and allocation engine, while keeping the individually-sourced ones in their sales agent’s bucket. Over and above, the mobile app provides role-based visibility to all prospect lists on a single pane of glass, simplifying the management of prospects from different channels.

2. How do you build your prospect pipeline and give your sales distributors visibility on the stage-wise prospect funnel?

Analytics and visibility of process information is key when prospects flow in from numerous sources. Important metrics such as straight-throughput rate, customer conversion, and stage-wise prospect funnels must be analyzed based on prospect source to optimize efforts.

Vymo steps in with a solution that provides best-in-class visibility and analytics, allowing clients to deep dive into their prospect pipeline. The ability to slice and dice data based on source, attributes and engagement activities empowers financial institutions to make data-backed decisions and strategically allocate resources.

3. Despite the high number of prospects flowing in, how can each distributor make their engagements more efficient and effective?

The sheer volume of prospects necessitates a nuanced approach to engagement. Now every prospect is not the same and a one-size-fits-all approach to engagement with each one can lead to decreased engagement effectiveness. According to the strategic survey done by Ascend2, improving engagement rate is a top priority for over 53% of marketeers. Vymo’s solution involves choreographing activity playbooks that guide individual sales agents through the customer acquisition journey using time-based or state-based nudges.

Consider a scenario where a lender wants their sales agents to connect with every prospect coming in from a LinkedIn outbound campaign within the first four hours. Vymo sets up a cadence that notifies the respective agent before the given time frame to reach out. Historically, this practice has significantly improved engagement and, consequently, prospect conversion rates.

4. Can repetitive tasks and standard outreach practices be automated to reduce the workload on sales advisors?

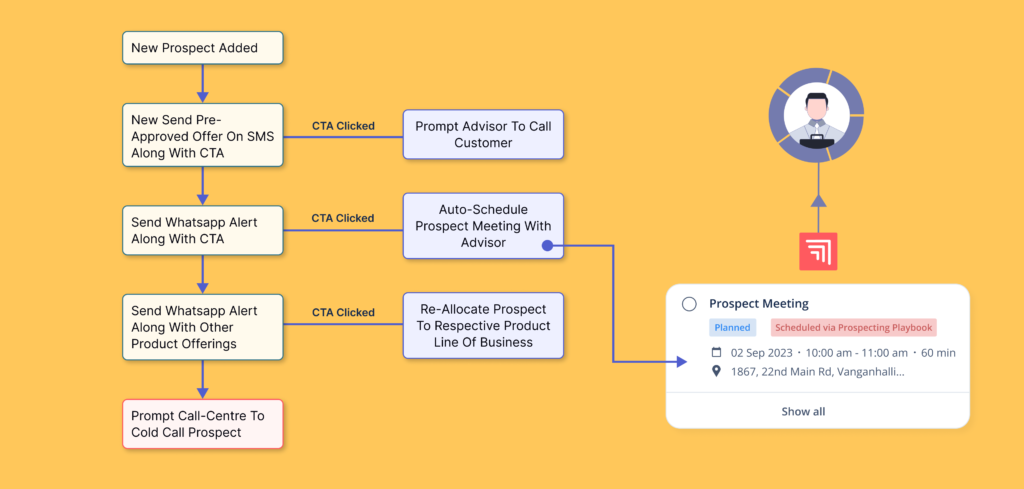

In an era where customer relationships management steals the spotlight, optimizing the time spent on fostering connections is crucial. Repetitive administrative tasks can hinder this process. Vymo’s automated prospecting playbook feature, coupled with time and event-based nudges to sales teams, allows clients to automate engagement activities such as sending emails, SMSs, scheduling appointments, and more.

For example, if a prospect is sourced from a four-wheeler auto dealership, the lender’s or insurance carrier’s playbook might dictate sending a templatized hello message with the standard product suite for auto loans or auto insurance respectively. As per this blog shared by Impactplus, digital channels now influence 92% of all B2B buying decisions. Vymo leverages its integrations with communication channels such as WhatsApp, SMS and emails to turn this into an automated activity cadence while carrying out disposition-driven prospecting.

Vymo’s solution transcends the limitations of siloed information, offering a unified platform that streamlines both the prospect acquisition and nurturing processes. Prospect sourcing empowers financial institutions to seamlessly aggregate data from disparate sources, ranging from traditional databases to online social media platforms.

The automated activity playbooks streamline the communication process, from initial engagement to conversion, enhancing efficiency and maximizing the impact of every interaction. The integration of automation not only reduces the workload on sales advisors but also allows them to focus on building meaningful relationships rather than getting bogged down by repetitive tasks.