According to a recent Cognizant Report, debt levels are soaring at an alarming pace, with U.S. debt now exceeding a staggering $35 trillion. The consumer credit landscape reflects this trend: while credit card lending has surged by around 50%, the number of credit card holders has not grown in proportion. BNPL sector is expected to grow at a CAGR of 20.2%, reaching $160.2 billion by 2032. The consequence? Spiking delinquencies, which have now reached 11%.

These patterns indicate mounting challenges for lenders and financial institutions in 2025, but also significant opportunities to innovate and improve debt collection strategies. As the industry faces pressures of higher delinquencies, rising defaults, and changing consumer behaviors, technology-driven trends will play a pivotal role in navigating this new landscape.

1. AI-Powered Debt Recovery:

In 2025, AI will drive enhanced debt recovery processes and dramatically lower operational costs. Key innovations include:

- Predictive Analytics: AI can detect repayment patterns, enabling lenders to identify high-risk borrowers early and act before they default.

- Dynamic Messaging: Automated, personalized messages based on borrower sentiment and behavior will ensure timely engagement.

According to McKinsey, businesses implementing AI in collections are expected to see:

- 40% reduction in operational expenses

- 10% improvement in recovery rates

- 30% increase in customer satisfaction scores

- 30% gains in productivity due to end-to-end transformation

AI allows for a more personalized, human-like approach while reducing costs and improving outcomes—a key trend for success in 2025.

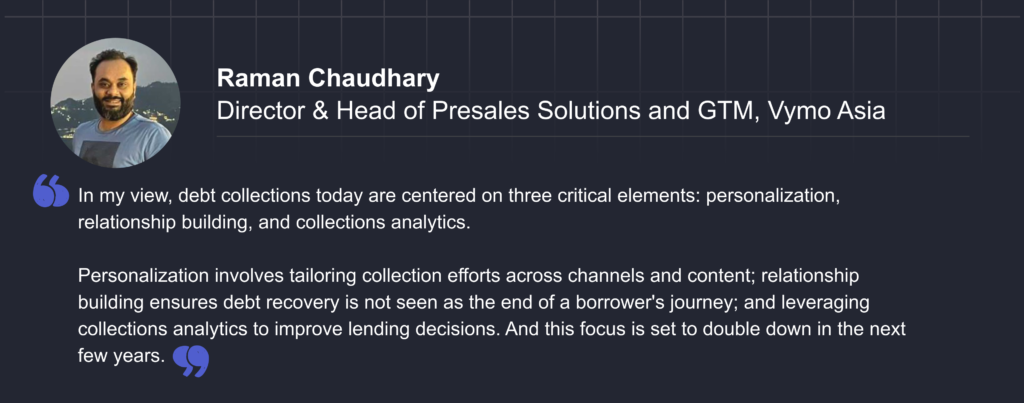

2. Digital-First Collections for Seamless Communication

In 2025, debt collections are embracing a digital-first approach that caters to modern consumers. As digitally-savvy borrowers prefer online communication, traditional phone calls are being replaced—or at least complemented—by omni-channel strategies:

- Personalized Messaging: Agents and borrowers can receive repayment reminders and nudges through SMS, email, chat apps, and mobile apps, based on their preferred communication channels.

- Real-Time Digital Notifications: Vymo sends real-time nudges to the agents, notifying of payment deadlines, overdue notices, and policy updates instantly.

By combining automation with convenience, financial institutions will enhance customer engagement, drive repayments, and improve overall operational efficiency in debt collections.

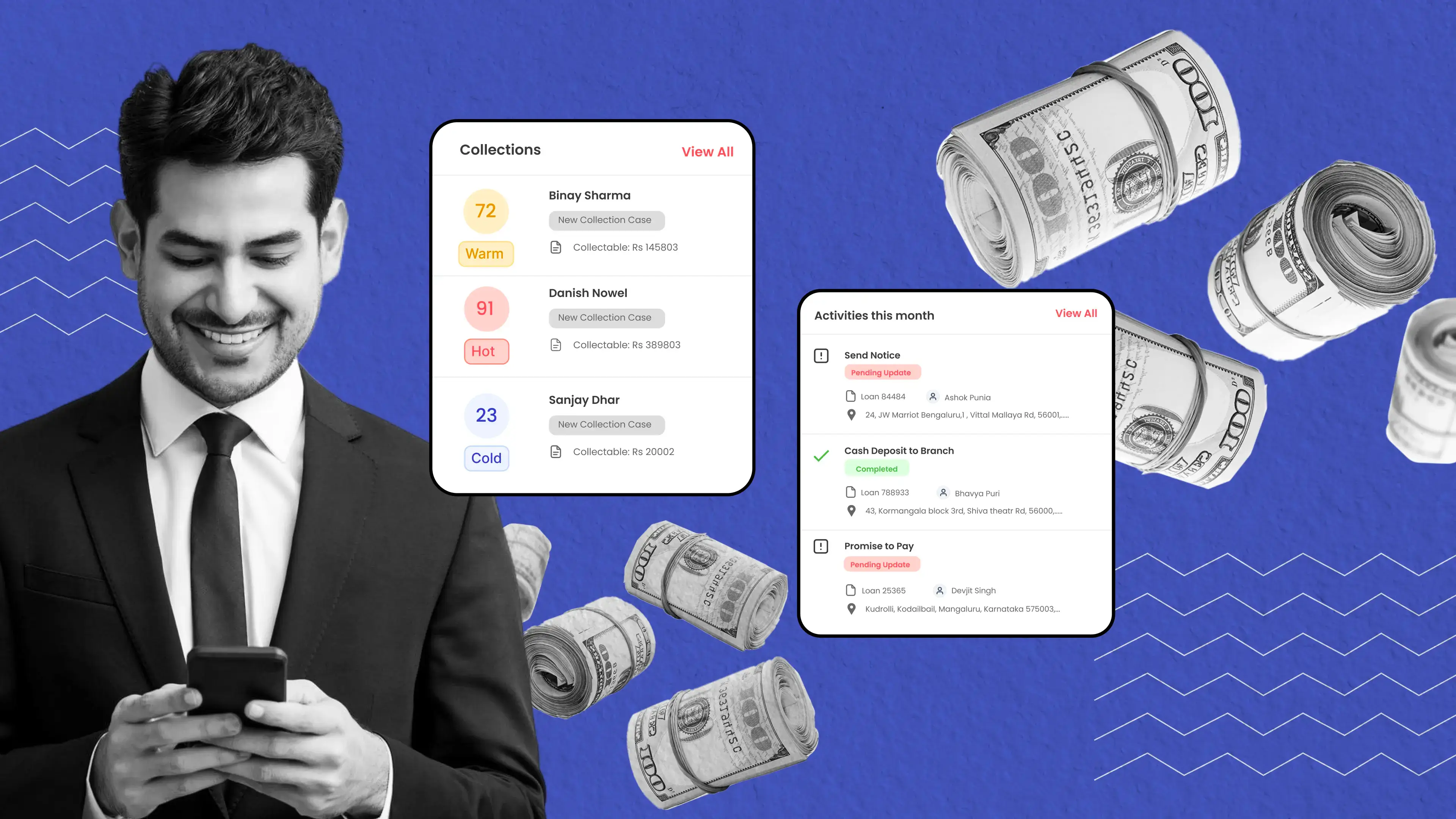

3. Field Collections Go High-Tech

While field collections remain a vital element of debt recovery—particularly in rural areas and for secured loans—technology is giving these collections a much-needed upgrade. Field agents can now work more efficiently and meet customer needs faster with the help of new tools and platforms.

- Mobile Apps with Geolocation and Instant Updates: Apps like Vymo can empower agents with real-time data, improving productivity and ensuring they have the right information to assist borrowers.

- Seamless Digital Payment Integrations: Vymo allows agents to share payment links on-the-go via integrated digital payment solutions, enhancing convenience.

- Gamification and Real-Time Tracking: With the introduction of gamification in the field, agents will track their performance, incentivize productivity, and foster a motivated team. This leads to more efficient collections and heightened accountability.

In 2025, field agents equipped with these high-tech solutions will drive more effective collections, with clearer transparency for both agents and borrowers, leading to faster recovery times.

4. Performance-Driven Technology Adoption

The collections landscape will see a significant shift in 2025 as industry leaders embrace technologies that maximize performance while driving down operational costs.

- Process Automation: Vymo helps agents to automate routine tasks, such as sending follow-up emails and reminders, through well-defined playbooks freeing agents to focus on more strategic customer interactions.

- Machine Learning: Algorithms will continually improve the decision-making process by learning from historical recovery data, ensuring better performance over time.

- Advanced Analytics: Financial institutions will gain deeper insights into customer behavior, enabling them to identify priority accounts, optimize engagement strategies, and track key performance metrics more effectively.

With the ability to automate and continuously learn from recovery efforts, collections will become more efficient, with better results, reduced costs, and higher overall productivity.

Time to Act: Preparing Your Collections Strategy for 2025

These trends are just the starting point. Whether you’re taking your first steps toward modernizing your collections strategy or accelerating existing efforts, the time to act is now. By adopting a future-ready platform like Vymo, you can streamline your entire debt collections journey, covering everything from pre-delinquency and recovery to hardship workflows.

Ready to discover how Vymo can enhance your collections efficiency in 2025? Let’s get started!