There’s a silent killer draining the profitability of your collections portfolio. It’s not the delinquent accounts themselves—it’s the outdated, manual process you’re using to chase them. Every hour your team spends wrestling with spreadsheets, planning inefficient routes, and manually dialing numbers that go unanswered is a direct hit to your bottom line.

With the Reserve Bank of India projecting a potential rise in gross non-performing assets (NPAs) for commercial banks, clinging to these old methods is no longer just inefficient; it’s a critical business risk. The future of debt recovery isn’t about working harder. It’s about working smarter with an intelligent, automated process.

We will discuss how Vymo CollectIQ automates each step, from risk-based case allocation to CXO dashboards, along with the key benefits, proof points, and your next step.

Understanding the Debt Recovery Process in the BFSI Industry

When you look at the debt recovery process in the BFSI industry, you follow a structured series of steps to bring overdue payments back on track. You begin by identifying delinquent accounts and classifying them based on risk or overdue bucket.

Once that’s done, you or your team reach out through multiple channels, such as branch visits, call centers, or digital touchpoints, to engage with customers. From there, you negotiate repayment terms, process collections, and ensure every action is tracked for compliance and portfolio visibility.

Challenges in the Traditional Debt Recovery Process

The conventional approach is buckling under the pressure of modern demands. Its flaws are becoming glaringly obvious.

- Manual case allocation using spreadsheets is slow and blind to risk.

- Delayed updates mean managers are flying blind, unable to track progress effectively.

- No visibility into field activities creates a black hole of accountability.

- Inefficient travel routes burn fuel and waste your agents’ most valuable asset: time.

- Sloppy data management creates compliance nightmares and missed recovery opportunities.

The Need for Real-Time, Intelligent Execution in 2025

Why the urgency? Because in 2025, your operations need to be real-time, AI-enabled, and mobile-first to survive. Real-time data gives you live control, AI provides the intelligence to focus your efforts, and a mobile-first platform empowers your team to execute flawlessly in the field.

This is exactly what a modern platform like Vymo’s CollectIQ is built for. It transforms collections from a reactive, manual burden into a proactive, intelligent system that gets results.

Debt Recovery Process Automated by Vymo’s CollectIQ

With CollectIQ, you overhaul your entire debt recovery workflow by embedding automation and intelligence into every step. Here’s the new reality:

1. Case Allocation Based on Risk and Priority

You no longer rely on a one-size-fits-all approach. CollectIQ’s AI engine analyzes customer data and assigns a dynamic risk score, giving you predictive insights instead of static criteria. This means your best agents can immediately focus on the highest-priority cases, helping you improve recovery rates from day one.

2. Smart Task Assignment to Field & Digital Teams

The system intelligently assigns tasks to the right team for the job. High-risk accounts can go to skilled field agents, while your digital team handles lower-risk cases. For agents on the ground, it automatically creates optimized travel routes, maximizing their efficiency.

3. Automated Digital Nudges and Reminders

A majority of your customers now prefer digital channels for financial interactions. With CollectIQ, you can leverage this shift by sending automated nudges through SMS, WhatsApp, and email—complete with secure payment links. This self-cure option makes it easier for your customers to resolve dues on their own while reducing the workload on your teams.

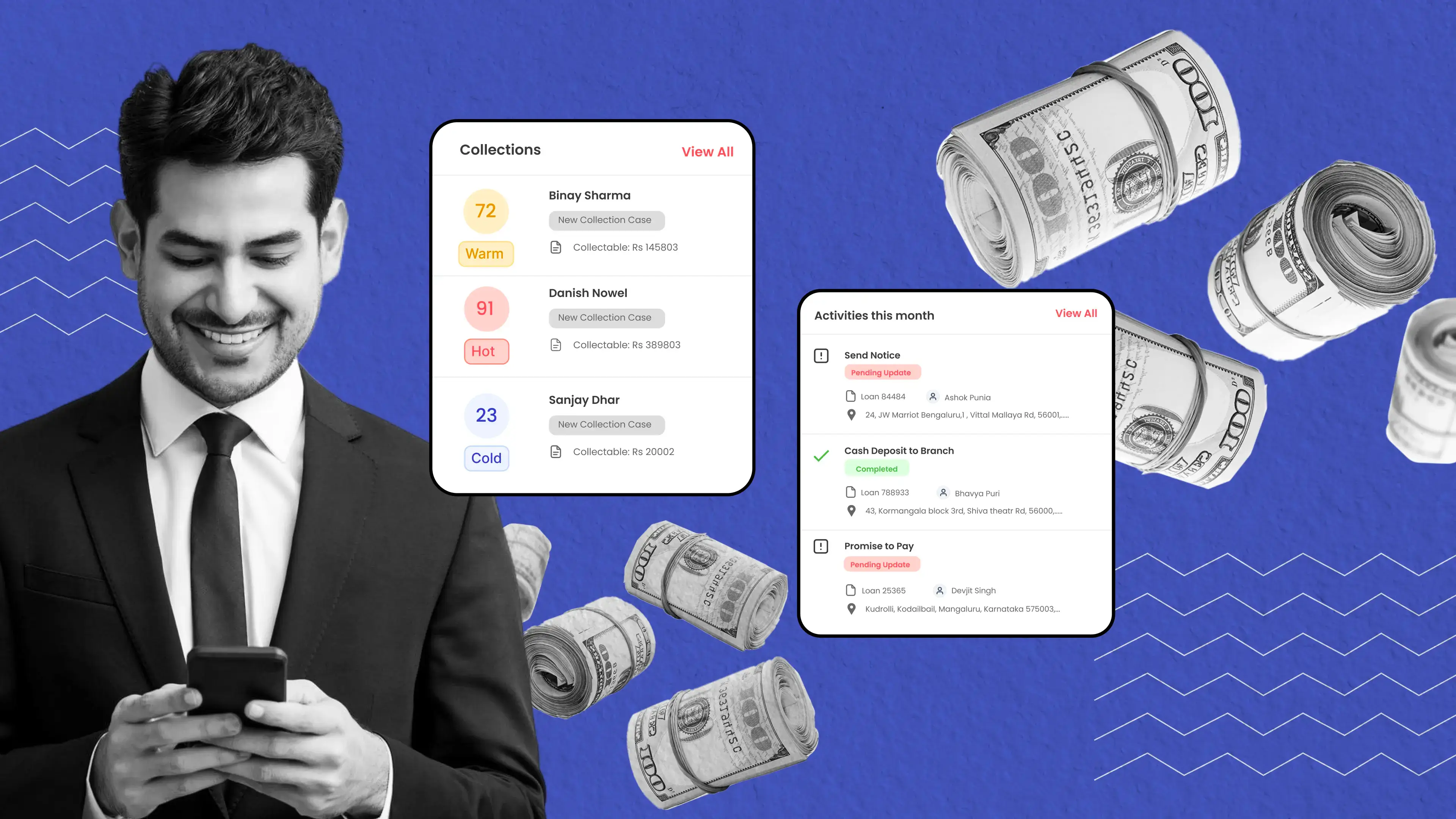

4. On-Ground Recovery with Mobile-First CRM

Your field agents become power users with a mobile CRM in their pocket. They have every piece of case information they need, can verify visits with geo-tagging, and can process digital payments on the spot. Every agent becomes a high-efficiency collection point.

5. Escalation and Dispute Management

The platform automates escalations so nothing is missed. If a customer breaks a promise to pay, the case is automatically flagged for the next action or sent to a manager. This closes compliance gaps and ensures every case moves forward.

6. CXO Dashboards and Portfolio Intelligence

Leaders get a clear, 360-degree view of the entire collections portfolio through live dashboards. You can track KPIs, monitor agent performance, and spot recovery trends as they happen. This gives you the intelligence to make agile, data-backed strategic decisions.

Key Benefits of Using CollectIQ for Debt Recovery

When you switch to an intelligent, automated process, you unlock powerful benefits across your recovery portfolio.

1. Improved Resolution Rates Across Buckets

By applying the right strategy to the right account at the right time, you see a significant improvement in resolution rates across all segments.

2. Lower Cost-to-Collect via Automation

By automating routine tasks and optimizing field activities, you directly lower your cost-to-collect. According to McKinsey, using this level of automation may help you recover debts 30% faster and at a 25% lower cost.

3. Enhanced Agent Productivity with Mobile Tools

When you equip your agents with effective mobile tools, you empower them to focus less on admin work and more on what they do best recovering debt.

4. End-to-End Visibility and Compliance Tracking

With every action logged automatically, you gain complete visibility and a solid audit trail. This makes compliance easier and puts you in full control.

Make your debt recovery process faster, smarter, and more cost-efficient with our AI-powered CollectIQ.

Why Leading Banks and NBFCs Trust Vymo’s CollectIQ

Vymo is the sales engagement platform of choice for over 350,000 users at more than 70 global BFSI giants, including HDFC Bank, Berkshire Hathaway, and Aditya Birla Capital.

CollectIQ is a mobile-first, AI-powered platform designed from the ground up for the specific debt recovery challenges in India and Asia. Its effectiveness has been proven across diverse portfolios, including unsecured loans, gold loans, and Buy Now, Pay Later.

Final Thoughts

Managing debt recovery with spreadsheets and guesswork is a recipe for failure. The future belongs to those who adopt automation and intelligence. Vymo’s CollectIQ offers a clear path to transforming your recovery process, enabling you to collect more, faster, and at a significantly lower cost. This isn’t just about adopting new technology; it’s about building a more efficient and profitable institution.

Ready to see how CollectIQ can redefine your collections strategy? [Book a Demo Today!]

FAQ’s

1. What is the process of debt recovery in a bank?

The process involves identifying overdue accounts, contacting customers, negotiating repayment, and collecting the funds. Traditionally, these steps are manual, tracked via spreadsheets, and lack real-time coordination.

2. How does Vymo’s CollectIQ automate the debt recovery process?

CollectIQ automates the entire workflow. It uses AI for intelligent case prioritization, assigns tasks to the appropriate teams, sends automated reminders, gives field agents a powerful mobile CRM for on-the-spot action, and provides managers with real-time dashboards.

3. Can debt recovery be optimized without growing the field team?

Yes. The goal of automation is efficiency, not just adding more people. By optimizing routes, prioritizing cases, and leveraging digital channels, CollectIQ makes your existing team far more productive, enabling them to achieve superior results.

4. What benefits does an AI-powered CRM offer in debt collection?

An AI-powered CRM delivers intelligent case prioritization, enables personalized customer communication at scale, provides predictive insights to guide strategy, and automates routine tasks, freeing up your agents to focus on high-value, complex negotiations.