If you’re leading a team in the banking sector, you’re on the front lines of a tough battle. The pressure to recover debt is constant but the old playbook is failing. Your teams are stretched, costs are climbing, and customers now expect a modern, digital experience—even for collections. Continuing to rely on manual processes and guesswork isn’t just inefficient; it’s actively hurting your bottom line and customer relationships.

The debt collection software market is projected to grow to $5.24 billion in 2025. This isn’t just a trend; it’s a fundamental shift. What if you could make your collections process smarter, more efficient, and more respectful to the customer? That’s what debt collection automation is delivering right now.

In this blog, you’ll learn how automation is reshaping debt collection and why it matters for you in 2025.

Understanding Debt Collection Automation

Let’s be clear. This is not about replacing your team with robots. Debt collection automation uses technology to intelligently manage the entire recovery lifecycle. It handles the repetitive and manual tasks that drain your team’s time and energy. This frees them to apply their skills to complex negotiations and sensitive cases where a human touch is irreplaceable. It’s about empowering your people to work smarter.

Why Debt Collection Needs Automation in 2025

The old way of doing things is struggling to keep pace. As we move through 2025, the weaknesses of traditional collections are clear. Consider that 94% of unknown calls go unanswered, meaning your agents are spending most of their day on efforts that yield no results. The core issues are simple:

- Field operations lack visibility. Managers are often in the dark about agent activities and effectiveness in real time.

- Recovery costs are increasing. Inefficient routes and time spent on low-priority accounts burn through your budget.

- Customer experience is getting worse. A McKinsey survey found 74% of consumers prefer digital interactions for financial matters. Old-school tactics are out of sync with their expectations.

- Compliance is a major risk. Manually tracking every interaction to meet strict regulatory standards is difficult and opens the door to costly errors.

7 Ways Automation is Transforming Debt Collection in BFSI

So how does automation solve these deep-rooted problems? It layers intelligence onto your operations, turning a reactive chore into a proactive, data-driven strategy.

1. Intelligent Case Prioritization with AI

Not all debt is created equal. Some customers need a simple reminder while others are at high risk of default. Instead of a one-size-fits-all approach, AI analyzes customer data to score each case. According to Experian, using this kind of predictive analytics can reduce delinquency rates by up to 25%. Your team can then focus its efforts where they will have the most impact.

2. Smart Field Routing and Task Automation

Picture your field agents starting each day with a perfectly optimized route on their phones. Smart routing automatically allocates tasks based on agent location, case priority, and even traffic. This simple change eliminates hours of manual planning. McKinsey reports that banks using automation can recover debts 30% faster and at a 25% lower cost than their peers.

3. Automatic Collection Through Digital Nudges

Many customers will pay if you make it easy for them. Automated systems can send personalized “nudges” through SMS or WhatsApp with a direct payment link. A Twilio study found that 89% of consumers prefer communicating with businesses via text. This self-cure option is convenient for them and incredibly cost-effective for you.

4. Unified Recovery Across Digital, Voice & Field

Your customer moves between channels and your collection strategy must follow. Automation platforms unify all efforts—digital nudges, call center conversations, and field visits—into a single view. This prevents disjointed communication and ensures a seamless, professional experience for the customer.

5. Automated Compliance & Escalation Rules

Staying compliant with regulations like the FDCPA is essential. Automation creates a digital audit trail of every action. According to an Accenture report, 60% of companies now use AI to help ensure regulatory compliance. You can also build in escalation rules, so if a promise to pay is broken, the system automatically triggers the next appropriate action.

6. Real-Time Dashboards for Recovery Managers and CXOs

Data is only valuable when you can act on it. Modern collection platforms offer real-time dashboards that give managers and executives a clear view of the entire operation. You can track collection rates, agent performance, and cost-per-recovery on the fly. This empowers you to make sharp, strategic decisions based on live data, not last month’s reports.

7. Gamified Performance Management for Field Agents

Keeping your frontline agents motivated is vital for success. Gamification introduces healthy competition through leaderboards and performance-based rewards. When agents can see their progress and how they compare to their peers in real time, it fosters a results-oriented culture and drives better performance.

What Makes Vymo’s Debt Collection Automation Stand Out?

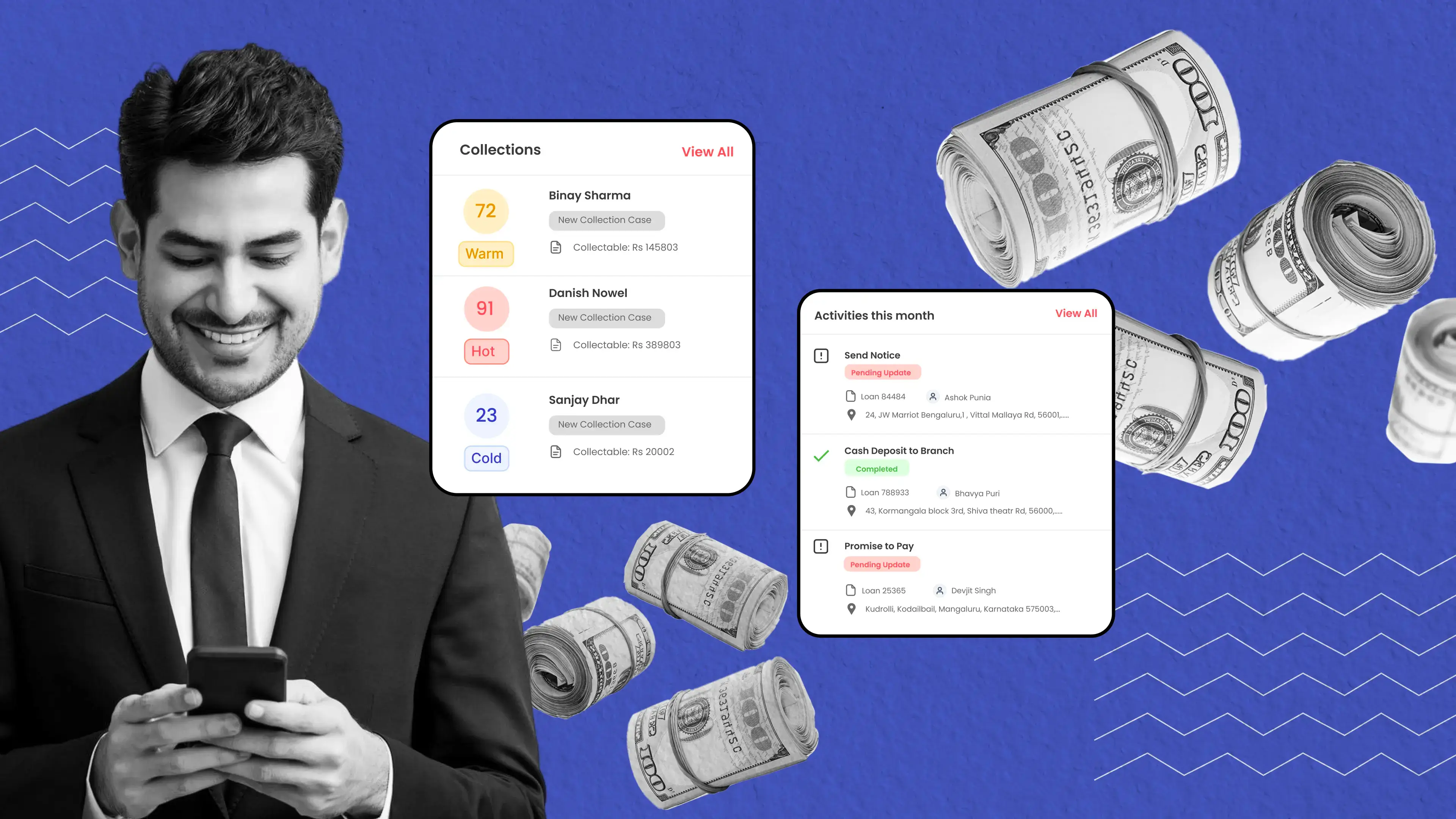

Choosing the right technology partner is key, but not all platforms are created equal. This is where Vymo’s CollectIQ moves beyond generic automation to offer a targeted debt recovery engine.

It acts as a single, intelligent system for your entire collections process, unifying key functions to maximize efficiency.

- AI-Driven Prioritization: At its core, CollectIQ uses artificial intelligence to analyze your portfolio and prioritize cases. This ensures your team is always focused on the most critical accounts first, rather than treating all debt equally.

- Complete Field Enablement: It empowers your on-the-go teams with a powerful, mobile-first platform. Agents get everything they need on their phones: optimized routes, full case histories, and the ability to process digital payments on the spot.

- Unified Operational View: CollectIQ brings together every aspect of collections—from auto-case allocation and real-time agent tracking to customer engagement and

compliance—into one seamless workflow. This eliminates data silos and provides managers with a true, 360-degree view of all activities.

By unifying these AI-driven insights with user-friendly mobile tools, CollectIQ helps leading enterprises like HDFC Bank, ICICI, Axis, Aditya Birla Capital, SBI Life and AXA turn collection strategies into measurable results.

| Feature | Value |

| Mobile-first CRM (Android + iOS) | Perfect for your field teams who are always on the move. |

| AI-powered case scoring | Helps your team prioritize the accounts that matter most. |

| Smart routing and task auto-allocation | Eliminates scheduling delays and maximizes field time. |

| Digital nudges with contextual workflows | Boosts self-cure rates and lowers cost-to-collect. |

| CXO-level dashboards | Gives you the real-time insights needed for strategic decisions. |

| Compliance-ready audit logs | Keeps you aligned with regulatory standards, effortlessly. |

Ready to transform your collections strategy?

It’s time to stop letting outdated processes dictate your results. Give your team the tools to succeed in 2025. Explore Vymo CollectIQ and Collection Management System—the most advanced debt collection automation platforms for BFSI institutions in Asia.

Book a Demo | Trusted by 350,000+ users across 70+ BFSI enterprises