In our predictions for 2023, three significant trends have reshaped the insurance landscape.

First, technology has become a central lever across the insurance value chain, with insurers redirecting investments to enhance functions like Sales Orchestration, Underwriting, Claims, and Analytics

Second, hyper-personalization has gained prominence as customers increasingly seek tailor-made products and benefits

And third, the focus on “protection” has surged, influenced by the pandemic, leading individuals of all ages to prioritize insurance plans that primarily address risks rather than solely focusing on investments

As we step into 2024, we anticipate several key trends that will shape the landscape of the insurance industry. These emerging patterns are poised to influence how insurers operate and interact with their clients.

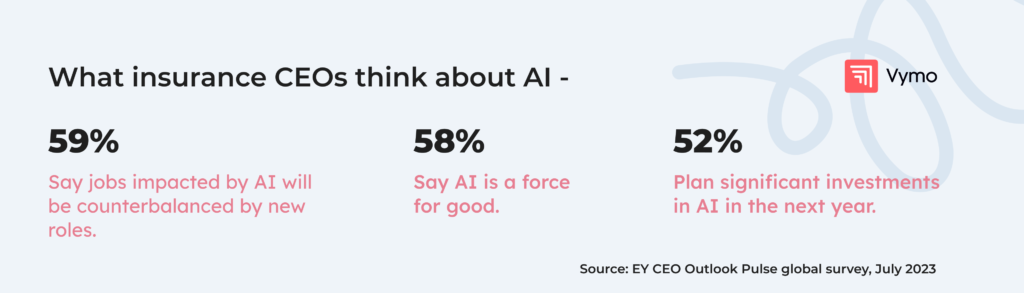

Trend 1 – AI in Insurance

In response to a rapidly changing environment, insurers must prioritize AI and advanced analytics for operational efficiency and long-term goals.

Despite the ongoing digital transformation, legacy constraints persist, prompting insurers to enhance customer interfaces using AI and advanced analytics to meet consumer expectations. The combination of AI and advanced analytics not only promises improved productivity and cost reduction but also serves as a potential disruptor to customer experience. This approach allows insurers to gain real-time insights into customer actions and sentiments, enabling targeted offers and services. AI can guide agents to pitch the right product in the right way and empower them to learn on the go through mobile-first experiences and virtual trainers for support.

Trend 2 – Uptick in Merger and Acquisitions

Globally, 449 M&A deals in the insurance sector were completed in 2022—the highest in a decade—up from 419 in 2021. While the macroeconomic environment in North America and Europe seems to be impeding activity in the near term, Asia-Pacific deals increased from 42 to 60 transactions year over year, with a 22% increase in the second half of 2022 – Economic Times

From a global deal perspective, several insurers in the United States and Europe are exiting more mature markets and exploring entrance into higher potential growth regions, such as emerging Asia-Pacific, given relatively low insurance penetration rates compared to more developed countries. Life insurers could be open to deals to transform their balance sheets. As drivers of synthetic profitability diminish and hedging risk increases, there may be an increase in activity either through reinsurance transactions or sales of closed blocks of business.

Trend 3 – Collaboration between Insurtech and traditional insurers

According to PwC, over half of the global insurers were facing heavy competition from rapidly-digitising firms that threatened net turnover. To combat this, insurers joined hands with InsurTech companies, which has now turned into a plethora of opportunities. With a reported valuation of over $3.81 million last year and an expected compounded growth of up to 51% by 2030, as reported by market research, the InsurTech industry is definitely one to follow. As we move towards 2024, the insurance industry is poised for enhanced collaboration between traditional insurers and insurance technology. This combines the wealth of experience of established players with the flexibility of processes supported by insurance technology. The collaboration wants consumer-focused products with more reproductive empathy.

Trend 4 – Service revenues climb while risk capital declines

To raise RoE and ease demands on capital as new loss patterns drive up indemnity and volatility, insurance carriers will go beyond traditional product offerings and deeper into advisory/services. Tele-health, care navigation and risk mitigation services will become a greater area of focus for carriers in 2024 and beyond, a report by Accenture suggested

Trend 5 -Climate risk and a focus on sustainability

It is estimated that up to US$183bn of premiums could be generated globally by 2040 as a consequence of climate change, mostly in the property insurance segment, given the threat of exposure to catastrophes such as floods, earthquakes, and extreme weather events like storms and wildfires. Because of their inherent expertise in risk management, insurers and reinsurers have a clear opportunity and societal obligation to lead the way in fighting the global climate crisis. Setting a long-term ambition that’s supported by tangible near-term commitments is the right first step to expand their relevance beyond risk transfer and to take an active role in changing outcomes on a broader scale.