In your world, where margins are tight and regulatory expectations grow stricter every year, you are under constant pressure to reduce costs while still delivering superior customer experiences. Traditional automation may have helped streamline some processes, but it still relies heavily on human oversight and often fails to scale efficiently.

This is where Agentic AI changes the game. Unlike systems that wait for your instructions, Agentic AI anticipates, decides, and executes actions autonomously. For you as a BFSI leader, this means leaner operations, stronger compliance, and higher profitability, all without compromising customer trust.

What is Agentic AI and How Will it Change Your Work?

Unlike traditional AI or machine learning models that only provide insights, Agentic AI functions as a proactive digital partner. It navigates complex workflows, sets clear objectives, and executes actions that align with your business goals, all while learning continuously to improve outcomes.

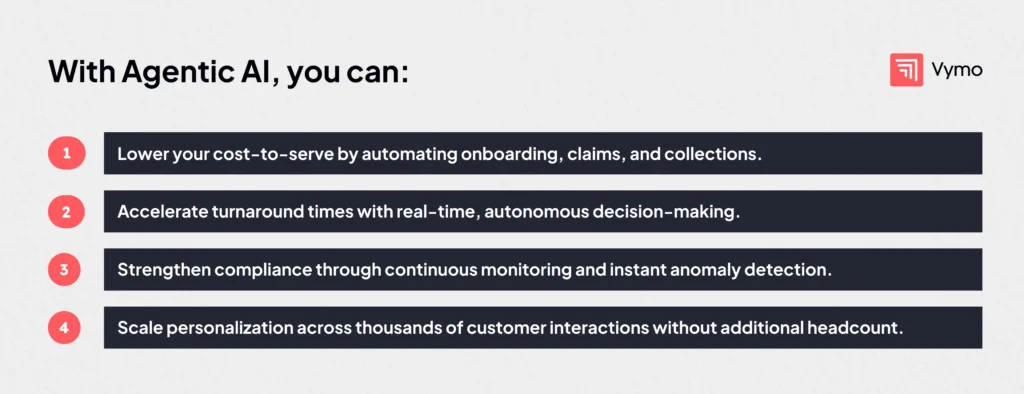

For you, this unlocks tangible advantages:

- From Insight to Action in Collections

Instead of just predicting risk, an AI agent acts. It sends automated reminders, negotiates repayment plans, routes cases to field agents, or escalates disputes, while ensuring full compliance logs are maintained. - Adaptive Sales Engagement

You no longer need to rely on blanket campaigns. Agentic AI personalizes outreach in real time, adjusting based on client sentiment, transaction history, and engagement patterns. - Dynamic Compliance Management

Instead of waiting for audits to uncover lapses, you can rely on AI to continuously monitor transactions, validate KYC, and ensure every disclosure meets regulatory requirements.

Agentic AI doesn’t replace your teams, it frees them from repetitive cycles so they can focus on making high-value decisions that impact revenue growth.

Why Agentic AI Matters for Your Operations

In BFSI, inefficiencies are expensive. High transaction volumes, fraud risk, and compliance demands mean that even minor errors or delays can result in significant lost revenue and reputational damage.

Think of Agentic AI as a digital co-pilot that works alongside your teams, empowering them to deliver consistent, compliant, and customer-first outcomes.

Where BFSI Leaders Are Saving Costs with Agentic AI

Here’s how you can start realizing cost savings and operational gains:

1. Automating Lead Engagement in Real Time

Instead of waiting for manual follow-ups, AI instantly qualifies, prioritizes, and engages leads, ensuring faster conversions and higher sales productivity.

2. Optimizing Field Collections

You can reduce delinquency rates as AI predicts repayment risks early, triggers outreach, and negotiates repayment plans, all while reducing the workload on your teams.

3.Intelligent Field Force Routing & Scheduling

By factoring in geography, urgency, and customer availability, AI helps you reduce travel costs while maximizing agent productivity.

4. Personalized Nudges to Drive Outcomes

You don’t need to micromanage; AI delivers timely prompts to your agents, reminding them to follow up on high-value leads or suggesting relevant cross-sell opportunities.

5. Compliance-Driven Automation in Onboarding

AI automates KYC verification, monitors disclosures, and flags anomalies in real time, helping you reduce onboarding errors and compliance risks.

6. Dispute Management in Incentive Payouts

You save time and prevent morale issues as AI auto-validates incentive claims, detects fraud, and resolves disputes faster.

How Vymo Helps You Operationalize Agentic AI

At Vymo, we don’t just provide you with data dashboards; we embed Agentic AI into your daily workflows, enabling you to see measurable outcomes.

- Real-Time Nudges: You and your managers get smart prompts guiding every agent toward the next best action.

- AI-Powered Insights: You gain predictive intelligence that highlights risks and opportunities early—whether in collections or cross-sell opportunities.

- Seamless Workflow Automation: Lead allocation, collections routing, visit planning—all happen automatically, minimizing manual intervention and maximizing accuracy.

With Vymo, Agentic AI becomes an integral part of your team’s daily workflow, enabling you to gain efficiency without disrupting your existing processes.

Why You Should Turn to Vymo

When it comes to operationalizing Agentic AI, the right platform makes all the difference. With Vymo, you get:

- Real-Time Nudges to ensure every agent action is optimized.

- AI-powered dashboards, such as SalesIQ and PartnerIQ, for actionable visibility.

- Seamless Automation that removes bottlenecks across sales, collections, and partner management.

- Continuous Learning that improves recommendations with every customer interaction.

The Vymo difference is clear: You don’t just get AI, you get operationalized Agentic AI that helps you cut costs, stay compliant, and deliver better outcomes every day.

Final Thoughts

For you, Agentic AI is no longer optional, it’s a competitive necessity. By embedding intelligence into your workflows, you can make your operations leaner, faster, and more customer-centric.

Forward-thinking BFSI leaders like you are already adopting solutions like Vymo to drive efficiency and growth. The real question isn’t if you should adopt Agentic AI, it’s how quickly you can bring it into your core operations.

Ready to see Agentic AI in action? [Book a demo now!]