Picture this, a salesperson walks into a meeting with a potential client. They start pitching their product or service, but the client’s eyes start to glaze over. The salesperson is confused. They’re using all the right buzzwords and industry terms, so why isn’t the client biting?

‘Cause, they don’t understand your finance jargon!

That’s right! According to a survey conducted by Standards and Poor, only ⅓th of the world’s youth population can be considered as “Financially Literate.”

As technology evolves rapidly and generations shift, understanding the financial acumen of customers has become more crucial than ever, especially for salespeople with new generations of customers like Gen Zs and Millennials.

April is National Financial Capability Month. Originally designated as National Financial Literacy Month in 2004, this observance has evolved to focus on financial literacy and ensure that Americans have access to unbiased and trustworthy financial education and understanding of financial services and products

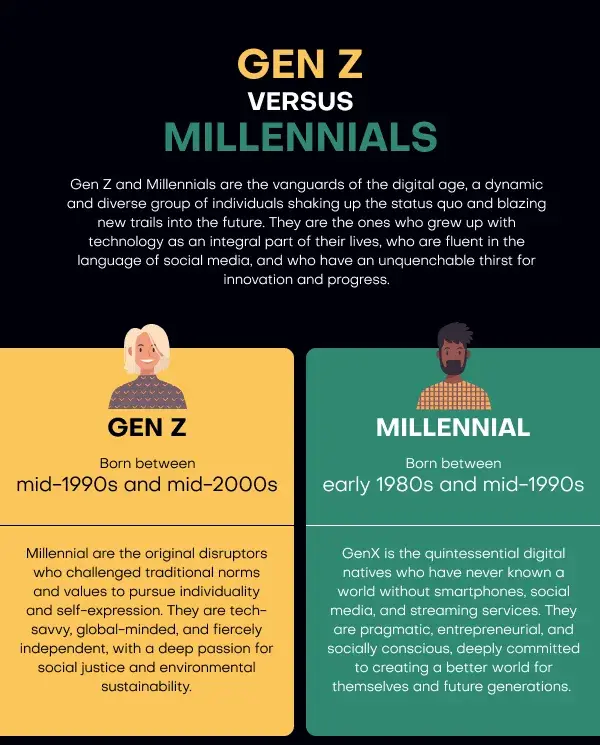

Who are the Gen Z and the Millenials?

Gen Z and Millennials are the vanguards of the digital age, a dynamic and diverse group of individuals shaking up the status quo and blazing new trails into the future. They are the ones who grew up with technology as an integral part of their lives, who are fluent in the language of social media, and who have an unquenchable thirst for innovation and progress.

Gen Z, born between the mid-1990s and mid-2000s, is the quintessential digital natives who have never known a world without smartphones, social media, and streaming services. They are pragmatic, entrepreneurial, and socially conscious, deeply committed to creating a better world for themselves and future generations.

Millennials, born between the early 1980s and mid-1990s, are the original disruptors who challenged traditional norms and values to pursue individuality and self-expression. They are tech-savvy, global-minded, and fiercely independent, with a deep passion for social justice and environmental sustainability.

With over 60% of the market share captured, these two generations are vital to every business. Their buying habits and preferences have a significant impact on the economy.

Let’s understand how Gen Z and Millenials spend:

- According to a 2020 survey by the National Retail Federation, 77% of Gen Z and 61% of Millennials prefer to use digital payment methods such as mobile wallets and contactless cards for in-store purchases.

- 70% of Gen Z and 63% of Millennials subscribe to at least one subscription service.

- Gen Z and Millennials say they would buy a product with a social or environmental benefit rather than cost benefits.

- Gen Z & Millennials have consistently trailed the older generation in banking and investing by an average of 10% to 15%.

- Gen Z & Millennials are more likely to rent a house than own one.

Understand the customer expectations:

According to Indonesia’s Financial Services Authority OJK, “Industrial revolution 4.0 is about digital transformation. The revolution demands banks to adapt and conduct changes.”

In this digital transformation era, customers seek a personalized touch with a nudge of digital support. They are looking for valuable advice and guidance about choosing the correct product. This type of guidance can help build trust between the salesperson and the customer, thus increasing sales and customer loyalty.

Give them a personalized touch

In addition to understanding the financial challenges Millennials and Gen Z face, salespeople need to communicate with these generations in a way that resonates with them. One way to do this is by leveraging technology. Personalize their services and modify and package the product according to their needs.

According to a study by Accenture, 68% of Millennials prefer to research and buy products online. This means that salespeople must be proficient in using technology to connect with customers and offer a seamless online experience.

Build a Tech Savvy team

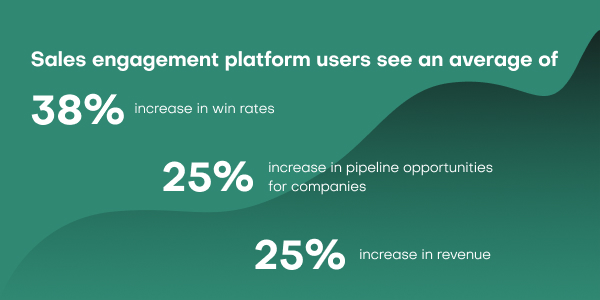

To cater to the preferences and expectations of younger generations, businesses must build a tech-savvy sales team using a Sales Engagement Platform. Here are some benefits:

- Connect with Gen Z and millennials on their preferred channels

- Personalize communications to appeal to younger generations.

- Increase efficiency and productivity.

- Track engagement and analyze data.

A sales engagement platform like Vymo allows salespeople to engage with prospects and customers on multiple channels, automate repetitive tasks, and provide valuable insights to optimize sales processes.

Driving business outcomes through data analysis

Data is crucial for every sales team regardless of the target group. Vymo helps by providing personalized communication, prioritizing sales activities, and optimizing sales strategies.

Personalization leads to higher engagement, prioritizing activities increases efficiency, and optimizing strategies lead to higher win rates. 90% of customers find personalization appealing, and personalized email messages have a 29% open rate compared to non-personalized messages, with a 17% open rate.

Measuring sales performance can lead to more effective sales strategies. 60% of sales reps say their top challenge is identifying the right prospects to contact. Sales engagement platforms can help identify the most promising opportunities and optimize sales strategies, resulting in a 15% increase in win rates.

Businesses can drive better outcomes by leveraging data through a sales engagement platform, resulting in increased revenue and customer satisfaction.

Are you looking for a way to streamline your sales team’s workflows and improve customer engagement? Get in touch with us today!