How mobile-first RMs will bridge the gap between the traditional and the digital

Imagine for a moment you are a Relationship Manager in 2021.

Your typical workday begins at 9.00 am with you checking e-mails and voicemails and browsing through the WSJ, Economist, and Bloomberg for financial inspiration. It’s a manic morning as you coerce your 11-year old daughter and 6-year old son to finish their breakfasts and get them ready for their Zoom classes.

An eternity later (or was it just fifteen minutes?) and after fortifying yourself with a tall order of coconut latte, you scroll through your calendar – you have 2 client meetings and 2 internal meetings lined up for the day.

At 10.00 am you video-call your first client (A local auto repairs business that is facing a financial crunch due to the Covid-19 pandemic ) and decide on the right terms for a 10-year loan. The session includes discussing any issues, general feedback, and updates from your side. After the call, you initiate the paperwork for the loan.

At 11.30 am you have a virtual huddle with the Product team on a new product that they are rolling out. You discuss the scope of the product and the target customers.

The afternoon is dedicated to onboarding a new client. The online workshop includes the new client’s team. There are a lot of faces in the ‘virtual room’ and you go into the details of features, training, bespoke requirements, and a macro-level project plan.

At 4.00 pm an unscheduled call takes up your time and your answer the client’s queries.

At 5.00 pm you wind down for the day after a meeting with the Compliance team. You review periodic targets and analyze the reasons if targets are not met.

Today is pasta day and you get started on cooking dinner while you catch up on the kids’ homework.

This is a far cry from 2019 when Relationship Managers were always on the road. ‘Meet-and-greet’ in 2021 happens virtually. Digital Transformation brings with it, its challenges.

Yet, RMs are still caught up in the era of legacy applications and relationship management systems.

In this complex landscape, Commercial Banks have to equip their RMs with the right solutions as personal relationships migrate onto the digital platform.

The Digital Relationship Manager’s role in the future will extend beyond the traditional trifecta of Selling, Analyzing, and Advising:

– SMEs are now leaning towards their banks for personalized guidance to reduce overheads, access funds, and maintain working capital.

– SMEs are gearing for a fluid relationship with digital technology as it embeds itself into the work-life fabric.

– SMEs more than ever need their banks to automate processes proactively and built a digital space to get quick answers

The Mobile-First Digital Relationship Manager

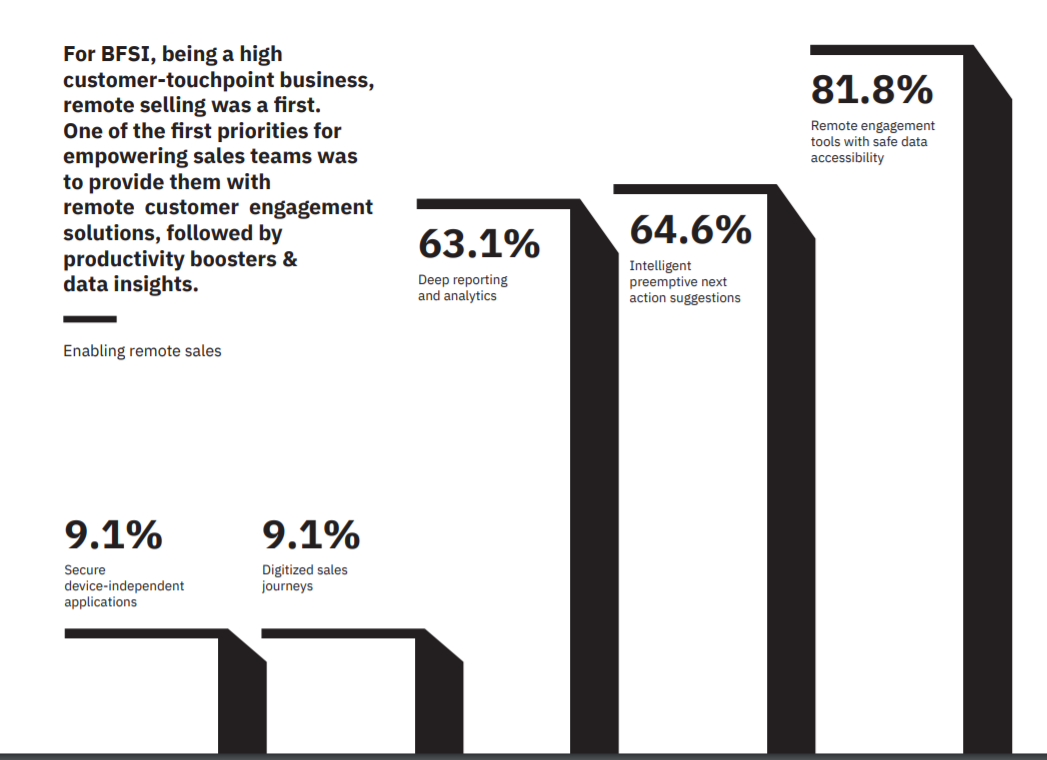

Commercial Banking is evolving rapidly and has gone virtual in the last 12 months. A recent survey of 15 changemakers in BFSI revealed that one of the foremost priorities was to empower sales teams with safe and secure remote engagement tools that are future-ready.

A Sales Enablement Platform is the ideal personal assistant to the Future-ready Digital RM.

With an intelligent personal assistant, the sales team can:

– Leverage a single platform for all their sales needs – from content to training to analytics – hence improving speed, accuracy, and consistency

– have real-time access to what customers need, when they need it, across each phase of their journey

– Drive preemptive interventions and improve outcomes via performance data and insights

– Align sales and marketing goals that drive revenue through relevant performance metrics.

– Reduce repetitive entry tasks through automation hence freeing up time for quality engagement with customers

– Built a central repository to promote consistency in messaging and for ready access during meetings

– Gain complete visibility of operations to ensure managers can coach their reps contextually

Finally, as SMEs the world over migrate to a digital environment, it is imperative to build a virtual bridge between small businesses and their RMs. Equipping RMs with the right insights and intelligence to drive the right information to the right clients can help accelerate the digital transition.

Vymo is a mobile-first, sales acceleration platform that collects rich contextual data of customer interactions automatically, learns from top performers, and then nudges the next best actions contextually to enable Relationship Managers to become trusted advisors of their SME customers.

What’s Next?

Keeping in mind that WFH is now the new normal, Vymo has launched smart Mobile-first solutions for the deskless banker. These include:

WFH Command Center Dashboard – for managers and management to get real-time visibility into key metrics – key customer engagement metrics across channels, customer sentiment, and team barometer reports, user adoption reports, etc.

Zoom and Whatsapp Call Launchers – Simple click-to-launch interface to route scheduled meetings and calls with leads, customers, and partners.