Insurance companies that have deployed technology have reported gains in nearly every area of operation, from compliance to product development, from operational efficiency to customer service.

Even during the recent pandemic, insurance companies that had strong processes running on robust digital infrastructure were able to absorb the shock better and recover faster. Thanks to the digital transformation efforts taken up earlier, they were able to engage their work-from-home teams, honor service requests, and drive growth in sales.

To put it simply, the benefits of CRM for insurance agents are more evident today than ever before.

But before we go into how CRM software can help you unlock insurance sales opportunities, let’s take a quick look at how insurance sales runs.

How sales and distribution works in insurance

Let’s do a quick recap of the three channels of sales and distribution in the insurance industry:

- Direct sales: These are the sales that your own teams on the field or your website have generated.

- Agency sales: These are the sales that your sales partners agencies bring through their own efforts.

- Bancassurance: These are the sales that your partnering banks have brought you.

Each channel brings its own insurance sales opportunities and challenges. For example, your banking partner has a ready database of clients who might already be looking for investment advice. However, banking regulations might have specific guidelines on how a bank can – or cannot – approach their customers to recommend insurance products.

The success of sales opportunities through each of the three channels, therefore, depends on how well your CRM and marketing automation can help you map the customer engagement journey.

How selling insurance is unique

Every business uses some form of selling or another to win more customers and generate business. Insurance too needs strong sales and marketing efforts to drive growth.

However, selling any form of insurance, whether it’s life insurance or general insurance, is unique in a number of ways. Here are some of them:

- Let’s begin with a widely known truth: insurance isn’t bought, it’s sold. Put differently, most customers don’t really ask for insurance, it’s your sales team that has to sell insurance. That’s because people are either not aware of or do not attach enough importance to the need of being adequately insured.

- Products like life insurance are long-term products. The benefits of a life insurance scheme are available only after the death of the customer. How’d you convince people to keep investing in something that’s going to pay only after their death?

- Unlike most industries, there’s a lot of sales and service overlap. In other words, customer relationships, built by timely and quality service provided by your teams, is perhaps the strongest opportunity to cross-sell or upsell.

- Insurance is governed by strong compliance. Selling anything that involves a lot of compliance is a big challenge, no matter how small the value of the actual sale is. A Deloitte article estimates that compliance costs for financial institutions have risen by 60%.

- There is a significant churn of salespersons in the industry. Every time someone on your sales team leaves, it can lower the efficiency of the efforts, because you’ll need to start a number of things from stage one.

Because not every salesperson on your team is a superstar, you’ll need an organized, centralised system that will optimize the entire sales process. That way, everyone on your team is geared towards success without loss of efficiency.

Limitations of insuretech legacy systems

Traditional insuretech was a great idea when it was introduced. It took a lot off the plate for insurance companies in terms of handling the mammoth data involved. The problem is that while software elsewhere evolved into smart solutions, traditional insuretech only remained massive record-keepers.

In the present context, these systems present some serious limitations. For example, they hold tons of data, but there’s no way you can generate meaningful data-driven insights that’d help you in insurance sales. They are not built to be used along with the modern, powerful social media platforms.

Moreover, there are major deficiencies in the legacy systems when it comes to integrating them with other systems or using them with various devices. In the modern world, where your sales teams run on smart-phones and tablets, anything that doesn’t merge seamlessly with multiple devices is a serious handicap.

Insurance CRM, the powerful sales automation tool

An insurance CRM (Customer Relationship Management) software contributes powerfully in developing and nurturing leads, converting them into paying customers, and profitably retaining those customers.

For example, contact management, one of the key functions of a CRM for insurance agents, enables you to hold the history of all the transactions and communications you’ve had with your contacts. That means that any time you get in touch with a contact or a lead, you know exactly where you left off last time and what should be your ideal next step. This optimises your team’s efforts when you’re nurturing leads.

A comprehensive insurance CRM software can help with all this and more. For instance, it can help you meet compliance requirements like the GDPR without your teams having to worry about it.

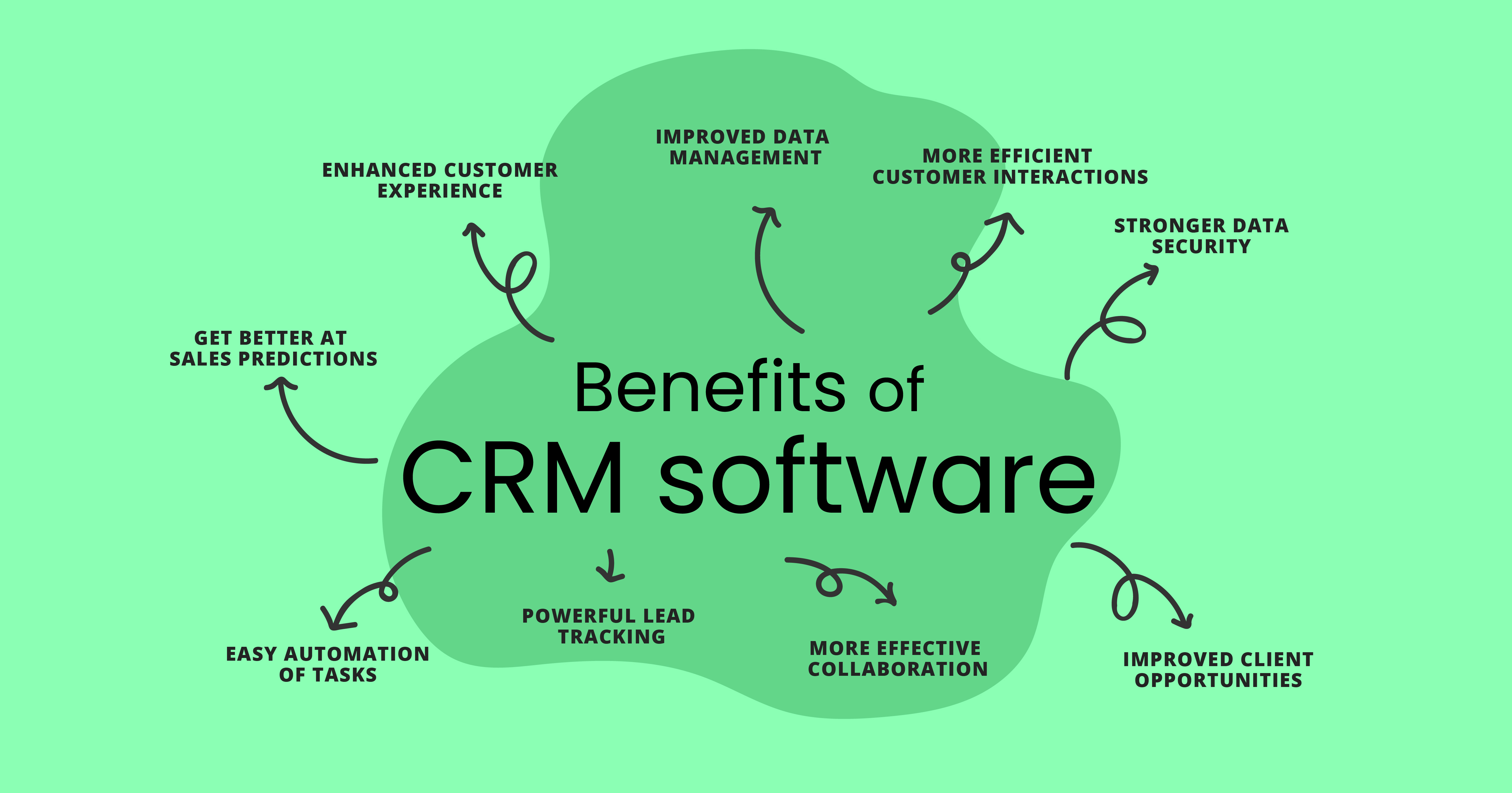

9 Benefits of CRM software for insurance agencies

We just mentioned how an insurance CRM can help you drive growth by attracting and retaining customers. However, the actual benefits of CRM for insurance go way beyond just increasing your sales figures (thought that’s hugely important too!):

Here are the top 9 benefits of CRM software:

1. Enhanced customer experience:

The key objective of using any technology should be to provide a positive customer experience. And why not? A study estimates that businesses that focus on customer experience see a rise of upto 80% in their revenue.

Your insurance CRM works hard to do this. In addition to tracking all your earlier transactions with the customer, it provides rich analytics. Based on your customer’s purchase history, preferences, demographics, and other factors, you can schedule and send personalized communications. This ensures your customers receive meaningful messages from you, not spammy trash.

Because you have a lot of relevant customer information, you will be able to provide timely service to the customer. We know we’ve said this earlier, but insurance has a strong overlap of sales and support. The better support you can offer to your customers, the more likely they’re to buy from you.

Finally, your CRM is the point of collection of all the relevant data about your customers. With that, you get an overview of the entire customer base

The macro-level insights you can generate will help you extrapolate future trends a little faster. With that understanding, you will not only be better prepared to meet your customers’ changing needs, but also help them proactively.

From just staying in touch with relevant messages to getting better at predicting future requirements, the CRM analytics can help you at every step.

2. Improved data management:

Yes, more data is available today than it has ever been. But before you figure out how to put that data to use, you must also answer the question: how will you store data?

Legacy systems aren’t competent enough to sort and organize data. That creates bits and pieces of fragmented data scattered around different departments. And siloed data can rarely generate insights.

Your insurance CRM software integrates all the data in one place. As a result, people in different roles access the same data. With this, your teams remain on the same page, leading to better coordination and performance.

Improved functioning of one team benefits other teams as well. Your claim settlement teams, for instance, can process claims faster because they have access to all the data they need. This leads to a positive customer experience. In the next step, your sales teams can leverage this improved customer experience to boost their sales outcomes.

3. More efficient customer interactions:

Your CRM system is at its best when it empowers you to perform two key functions: pleasing existing customers and winning new ones.

Technology-driven operations enable organizations to collect even small bits of information.. This helps insurance companies perform equally well in regular as well as unforeseen, unprecedented scenarios, like the Covid-19 pandemic. All this will require software solutions that work smoothly with external systems too, something that CRM is well geared to do.

Your insurance CRM can integrate technology with your organizational operations. That means every time your sales and support teams interact with customers, they will have a strong system to serve them. The information that you have on your customer enables your teams to address concerns faster and more meaningfully.

4. Stronger data security:

With the implementation of the GDPR and the CCPA, data security and privacy have become more challenging than ever. These regulations have provisions for severe fines, making compliance a priority area.

With 66% of industry influencers citing security as their biggest challenge (Source), leading cloud-based CRMs have more than adequate protections in place. This means that no matter what the size, speed and variety of data your CRM carries, your data is always secure. Coupled with data-collection best practices, your CRM enables you to easily meet strong compliance requirements.

A strong CRM solution will make ample provisions to protect the data you hold. Salesforce, for example, manages its data-centres with the highest degree of security required. High redundancy, multiple data paths and healthy RTOs and RPOs are some of the many features that your CRM system has in place to ensure your data is secure and well-guarded.

5. More effective collaboration between company and the customer:

If customers have to submit requests at multiple touch points or register preferences at more than one place, you are only making their lives difficult. And when you make your customer’s life difficult, you’re on the sure track of losing them.

A CRM system for your insurance business builds true collaboration between your company and your customers. All the needs, preferences and requests from the customer are integrated here. This provides your support and sales teams with everything they need to better meet the customer’s requirements.

The customer also finds every communication with your teams more meaningful. That’s because every communication is geared towards providing solutions, instead of filling the information gaps over and over again.

6. Powerful lead tracking:

Your marketing teams and partnering agencies invest lots of energy and resources in generating leads. It’s only natural that your sales teams should be enabled to make the most out of these opportunities.

As mentioned earlier, your insurance CRM software records the preferences and history of all your transactions with customers. Similarly, leads are tracked efficiently. Your managers know exactly which leads were assigned to whom and when. They also know the stage of leads and can learn if the deal is closed.

On the system, your sales people will be able to drag-and-drop leads from one stage of the system to another. Based on this, your managers can decide what action needs to be taken in order to fully capitalize the lead.

7. Easy automation of tasks:

If there’s one thing that holds back your sales teams, it’s the monotonous drill of repeating the same tasks over and over again. They – often rightfully – feel they’re helplessly tied down to the processes that add no direct value to their sales efforts.

Your insurance CRM solution has the amazing ability to automate many tasks. For instance, automation can cut claim processing time by as much as 50%. (CompareCamp). Or take emails. Let’s say your salespeople need to send emails to people in different time-zones. No problem. Your CRM will enable your salespeople to easily schedule these emails. Cold emails, follow-ups, quotations, updates,… anything you feel like sharing with the prospect, your CRM helps.

That’s just one of the many activities your CRM can so effortlessly automate. Looking for voicemail scheduling? Sure, your CRM is available. Want to log all your calls? No problem, your CRM will take care of that. Scheduling appointments and integrating with your calendar? Sure, your CRM can handle that. The list can go on and on.

8. Get better at sales predictions:

Yes, sales predictions are, well, just predictions. But the thinking and the process that go behind a prediction can make all the difference.

Insurance is essentially your customer’s way of protecting and safeguarding themselves or their property against unexpected risks. Towards that objective, they disclose various key information to you, including insurance-specific factors, like the extent to which they’ve gone in the past for risk mitigation.

Armed with this knowledge, your insurance CRM can help you build sales predictions and make valuable estimates about likely sales. This will tell you how much resources and time you should be spending on a particular lead. This keeps your sales and support teams performing at peak efficiency levels, because they’d be able to limit their follow-ups to optimum levels.

9. Improved client opportunities:

Your CRM can, among, other things, help you create, refine and better define your buyer persona. That’s because of the unusual amount of insights it carries within its data.

With this, your sales teams know with a very high degree of precision what prospects should be pitched which insurance product. Given the huge number of insurance policies out there, your teams will find this narrowing down extremely efficient.

Your CRM creates client opportunities by helping you with cold calls. The insights from this software can point out which product a prospect is most likely to buy, even if the prospect hasn’t requested for insurance.