Banking, Financial Services, and Insurance (BFSI) sector sales teams often grapple with prioritizing leads to optimize their conversion rates. The traditional methods of lead scoring, often based on intuition or limited data, are no longer sufficient in this digital age. Data-Driven Lead Scoring emerges as a powerful tool to revamp sales strategies, enabling BFSI sales teams to prioritize leads more effectively.

Data-Driven Lead Scoring: The Concept

Data-Driven Lead Scoring is a strategic approach that uses data analysis and predictive analytics to score and rank leads based on their likelihood to convert. This method leverages a wide range of data points including demographic information, browsing behavior, and interaction history. A calculated score is assigned to each lead, guiding the sales teams on which leads to focus their efforts on. This not only optimizes the sales process but also improves the overall performance of the sales team. According to a study by Information Technology and Management, ideal lead scoring models deliver excellent results in annual revenue (i.e., a 50% average increase)

The Impact on BFSI Sales Teams

Data-driven lead scoring transforms BFSI sales by eliminating bias, and personalizing interactions.

- Improved lead conversion: Improved lead allocation resulting from lead scoring, resulting to increased conversion rates.

- Efficient Prioritization: Understanding high-converting leads helps prioritize efforts, boosting conversion rates and sales productivity.

- Bias-Free Decisions: Elimination of guesswork and bias leads to more objective decision-making.

- Customer-Centric Approach: Personalized interactions based on lead data enhance the sales process, meeting individual needs and preferences

Leveraging AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies has been pivotal in advancing data-driven lead scoring. These technologies enable the continuous analysis of lead data, refining scoring models over time to improve accuracy.

AI and ML have the capacity to process and learn from vast amounts of data at an unprecedented rate. This means that they can continually refine and improve the lead scoring algorithm based on the latest data and trends. This constant learning and adapting process ensure that the scoring model remains relevant and accurate, even as the market dynamics change.

Moreover, the use of AI and ML can enable real-time lead scoring, providing sales teams with immediate insights into the potential value of a lead. This can significantly speed up the sales process, allowing sales representatives to respond more promptly to high-potential leads.

Vymo’s machine learning-based allocation model ensures that leads are rightly assigned to the most suitable sales representatives.

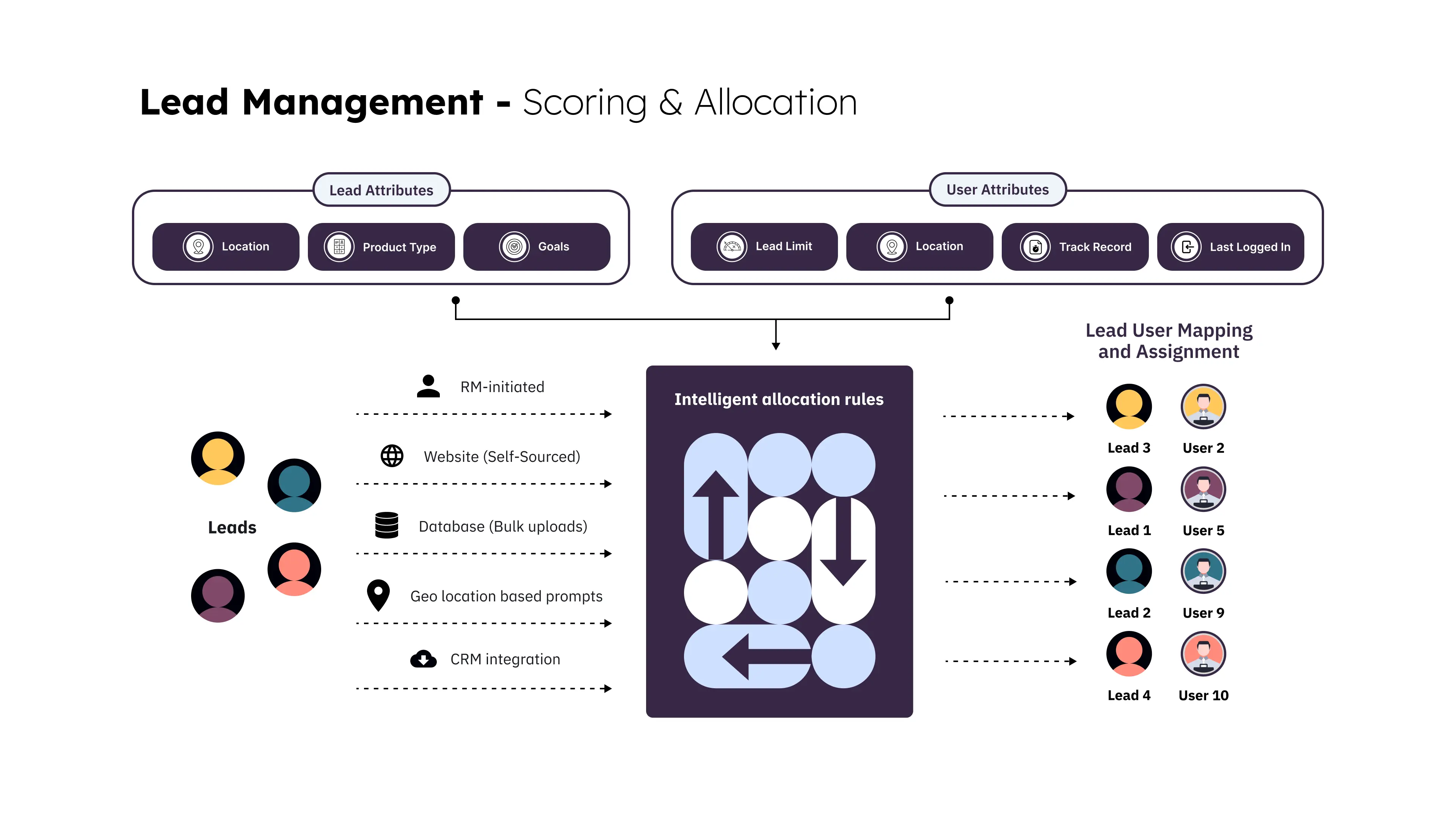

The illustration above depicts Vymo’s Lead Management Journey. The leads can be sourced through various channels including RMs, websites, databases, and CRM. These then go into the lead scoring engine where they are categorized in order of priority and then allocated to the right sales rep. This allocation can be done on the basis of certain defined rules or can be ML based. The process is optimized so that the right lead goes to the right rep who has the highest chance of converting the lead.

To read more about the lead management solution at Vymo, CLICK HERE or contact us at hello@getvymo.com.

[…] Predictive analytics, for example, forecast future sales trends and identify opportunities for revenue growth. By leveraging historical data and machine learning algorithms, Vymo can anticipate customer needs, prioritize leads, and personalize engagement strategies for financial institutions for maximum impact. More on Vymo’s data-driven lead scoring has been explored in this article. […]