As emerging technologies like generative AI, Web3, and Metaverse become increasingly important, implementing a cloud-first strategy is essential and cannot be ignored.

Vymo hosted a roundtable with leading public sector banks (PSUs) leaders in Mumbai. The conversation concerned charting robust cloud policies and the roadmap for PSUs in the coming decade.

Vijayant Rai, Country Leader, BFSI, Microsoft India, was the keynote speaker, and he pointed out that the opportunity for cloud adoption is not slowing down. Businesses have adapted the cloud to help them navigate supply and demand uncertainties of the pandemic and help them reimagine their business digitally. AI adoption and investment is up and is being applied across every industry and use case to solve real-world challenges.

Why Cloud?

The latest forecast by Gartner says that worldwide end-user spending on public cloud services is predicted to grow 21.7% to a total of $597.3 billion in 2023, up from $491 billion in 2022. Back home in India, the numbers sound promising – according to IDC, the overall Indian public cloud services market is expected to reach $17.8 billion by 2027, growing at a CAGR of 23.4% for 2022-27.

Cloud infrastructure and tools today allow organizations to innovate and deploy products and strategies with a faster time-to-market

- Speed to innovate – 20%-30% Optimization of overall computation capacity for faster product enhancements. – Cloud-based tools and techniques provide high operational efficiency and agility in innovation for a faster time-to-market.

- Productivity (Ease of use) – 35%-40% increase in employee productivity. – Seamless integrations over cloud means simple, easy-to-use UIs, smooth flow of data between systems, and higher visibility.

- Cost-effectiveness – 50%-70% reduction in Total Cost of Ownership (TCO) on IT infra.- Generate revenue almost immediately – Cloud requires nearly zero upfront costs as most tools are subscription-based.

- Customer centricity – Improve customer proposition and tap into newer customer segments by gathering valuable data and insights from multiple sources.

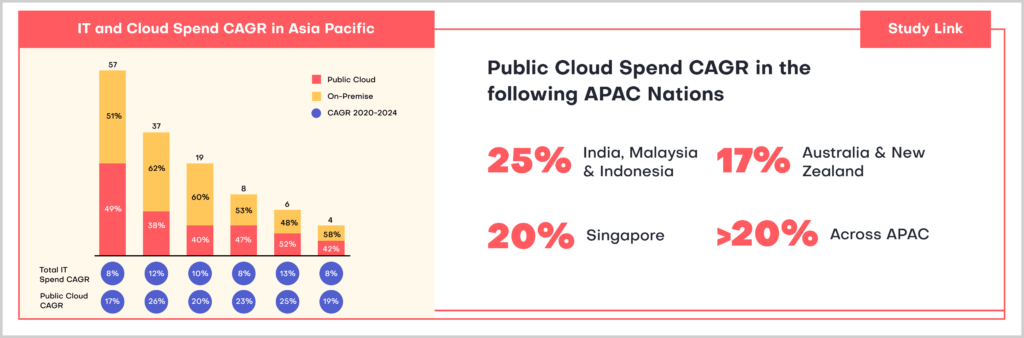

There is a strong shift towards cloud technologies in the Asia Pacific region, with India, Malaysia and Indonesia being key markets.

How can Banks Adopt a Successful Cloud Strategy?

To initiate cloud technology and digital transformation adoption, a holistic strategy should be adopted to automate the IT environment through an agile operating model.

Rajesh Sabhlok, Managing Director – Asia Pacific at Vymo, shared that organizations must learn from each other and factor in best practices to make cloud deployments successful –

- Budget – Maintaining expensive infrastructure with low utilization is costly. Cloud computing allows for rapid and flexible expansion or contraction of services based on usage, resulting in financial savings.

- Shared services model – Outsourcing non-core processes like customer onboarding and outbound marketing can reduce costs per transaction and customer acquisition expenses.

The New Cloud Era

Cloud platforms are opening up deep blue ocean opportunities for Banks. The new regulatory guidelines by RBI will further nudge Banks to accelerate their cloud adoption.

Cloud transformation will help the Bank of the Future to improve revenue generation, increase customer insights and contain costs –

- Customer delight – Better integration of business units through sharing data, driving integrated decisions, and moving more quickly to solve customer problems.

- Single pane of glass – Gain the ability to replicate and access data and app services across more than a single data center or region.

- Attract new talent – Tech capabilities and solutions attract new workers and provide access to ecosystems with unique skill sets.

The future of Banking is in the Cloud, and it looks bright and sunny.