2023 is being dubbed as the year of AI transformation. How we generate, manage and propagate Data will redefine life as we know it. Our conversation with Suresh Neelakantan, Senior Business Development Director – Value Chain Innovation Laboratory at NEC Asia Pacific surfaces the opportunities and challenges of a data-forward Insurance organization.

Data Dividends

On the Digital Evolution of Insurance

When we look back to our parents’ era, we realize there was limited awareness about Insurance as they had a low-risk appetite. In today’s world, however, there has been a demographic shift.

Digital adoption has transformed the market for services and products, impacting consumer experiences in areas such as retail and banking. The same applies to Insurance as well. The rise of digital solutions has fundamentally altered how customers engage with businesses, particularly in the insurance industry. As a result, products within the space are constantly evolving. Conversations are becoming more electronic and digital, so much data is generated based on these interactions. This data is crucial for several reasons, including customer service, acquisition, and fraud management.

On the Future of Insurance Sales in Thailand

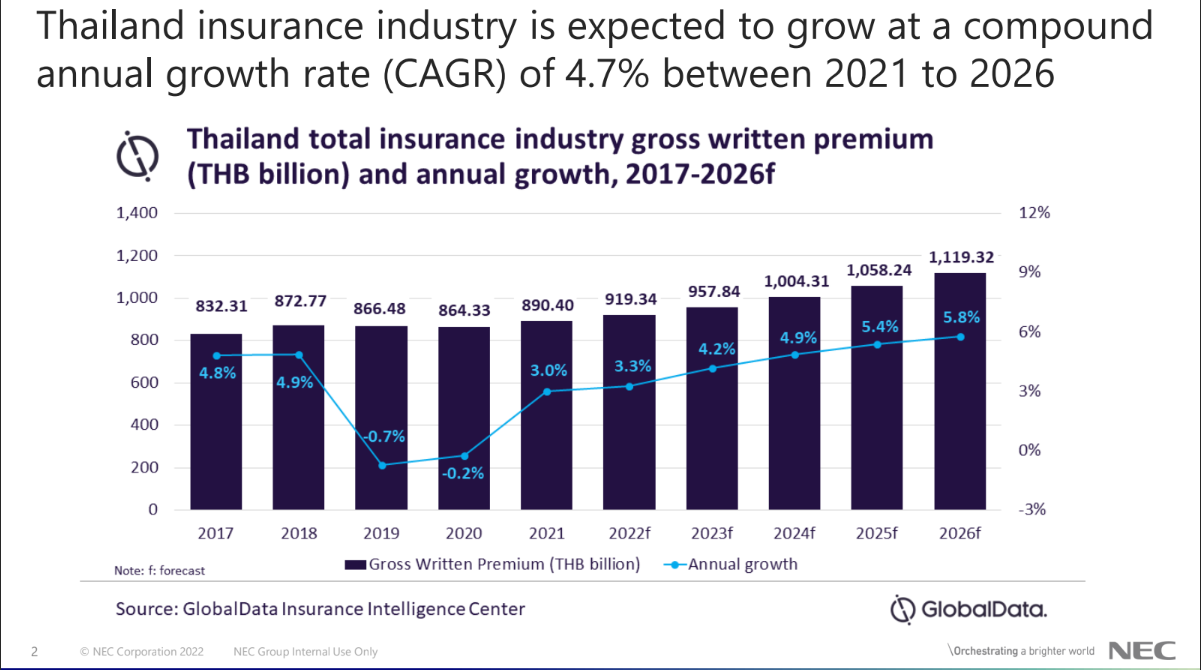

Thailand’s insurance sector is expected to experience a Compound Annual Growth Rate (CAGR) of 4.7 percent from 2021 to 2026, resulting in a massive 1,119 billion Thai baht in written premiums by 2026. Thailand has a high rate of digital adoption, with mobile subscriptions reaching 133 percent. This means that for every person, there are 1.3 mobile subscriptions. Internet use is 82%, and active social media use is 74%. In comparison, insurance penetration in Thailand is only 5%.

This presents a significant opportunity for growth in the insurance sector and points us towards the future of sales engagement, which is moving from in-person to online.

In the past, the older generation would purchase Insurance through sales agents. However, in today’s world, Millennials and Gen Z are more inclined to shop for Insurance online rather than meeting with a sales agent. They prefer to compare the various online options and select the product that best suits their needs. Therefore, the current generation expects the insurance product offerings to be more relevant to their preferences.

Data becomes very important for an insurer to offer products that are hyper-personalized.

On Personalizing and Gamifying User Experience

The concept of Insurance is that it needs to be affordable. Otherwise, due to high premium costs, most customers will shy away from buying the product.

Say ‘Person A’ buys a smartphone, which comes with Insurance covering damages, breakages, failures, etc. Should ‘Person A’ pay a one-time flat premium, or should the premium be based on behavior analysis?

Collecting data can aid insurers in making decisions based on the individual’s life journey. As an insurer, it is crucial to manage the contingent liability effectively. To achieve this, access to the right data is necessary to evaluate the associated risk, analyze data, and use artificial intelligence to provide a weighted average of usage and corresponding premium.

Driver Behavior Profiling is a critical use case in the context of personalization and gamification of the user experience. For instance, let’s take the example of a Fleet Operator named ‘Person B’ who runs a truck business. Along with salaries, the most significant cost for B is the road tax and Insurance. To offer customized premiums, insurers can profile driver behavior using advanced technology. This entire process can be gamified where drivers can be incentivized for good behavior, and data can be used to educate Person B and the drivers on winning behaviors. As a result, the cost of Insurance can be reduced due to a decline in the cost of claims, making Insurance affordable.

AI and data science capabilities can be used to predict claims and deduct frauds. The benefit of this model is that it is preventive and helps manage contingent liabilities.

On Green Insurance

The impact of Insurance on carbon footprints is a very important topic to me. Many people, including myself, travel frequently and worry about its negative impact on the environment. Most airlines suggest that purchasing carbon credits can help offset carbon footprints. They say that the money will be used to plant trees or invest in green funds. Travel insurance companies can also offer coverage to offset carbon footprints. This can be an added incentive for people, highlighting the significance of data when making environmentally conscious decisions.

———–x————

About:

NEC is a leading ICT (Information and Communication Technology) company, established in 1899, more than 120 years ago, and started its business in Thailand in the 1960s.

Suresh Neelakantan is the Senior Business Development Director – Value Chain Innovation Laboratory at NEC Asia Pacific. Suresh is an accomplished digital transformation veteran with over 22 years of experience in the banking industry. He leads transformational thinking with proven results across the digital product management spectrum.