Post Covid 19 pandemic, the insurance industry experienced a noticeable impact, with premium growth slowing to around 1.2 percent in 2020, in contrast to the steady growth of over 4 percent per year witnessed between 2010 and 2020.

The most significant drop was observed in the Asia-Pacific region, where profits plummeted by 36 percent, primarily due to declining profits in the life insurance sector.

Current State – An ongoing fight for the customer

Insurtech companies are causing significant disruptions in the insurance industry. The investments in Insurtech firms globally have grown substantially, from $1 billion in 2004 to $7.2 billion in 2019 and reaching $14.6 billion in 2021. Among these Insurtechs, more than 40 percent are concentrated on the marketing and distribution aspects of the insurance value chain. Their focus on leveraging digital technology enables them to address customer pain points and provide an enhanced client experience, which could potentially challenge established insurance companies in the market.

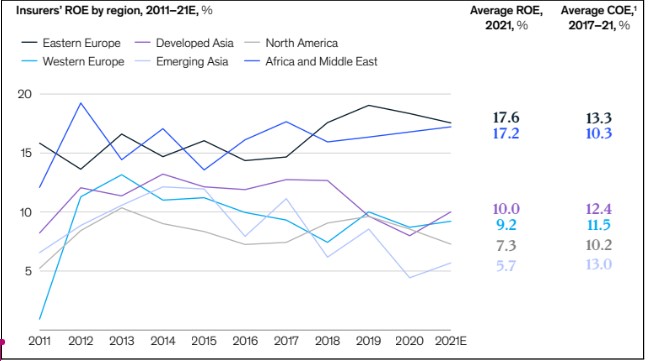

Following decades of consistent returns, the insurance industry is currently experiencing a decline in value, with around half of its participants failing to generate returns that meet their cost of equity.

Strategies to boost the insurance sales process

Be an educator and advisor, not just an agent – To effectively sell insurance, it’s essential to recognize that most customers, whether individuals or businesses, find insurance confusing. They are unlikely to be familiar with the various types of insurance options. Thus, building credibility and trust with your prospects becomes crucial before engaging in the sales process.

In this blog, Don Bailey, AIG – Global Head of Distribution & Field Operations, explains, “Since the insurance sale involves an intangible product (a promise), the credibility of the seller is critical. Given that, the sales cycle is often longer than a tangible product sale.”

Personalize the insurance experience – Customers today seek personalized experiences. According to Accenture, 77% are willing to share data for lower premiums and personalized coverage recommendations. However, only 22% feel companies cater to personalized data. Standing out with personalization can lead to a 58% increase in customer spending with a provider they trust.

Data-driven sales optimization – By harnessing the power of data analytics, insurance companies can unlock valuable insights into customer behavior, preferences, and buying trends. This data-driven strategy enables them to optimize their efforts, focusing on the most promising prospects and tailoring their sales approach to resonate with each customer’s unique needs.

Product innovation and coverage of new risks – Insurers can seize opportunities by innovating new products to address emerging risks, reallocating capital between personal and commercial lines, and establishing strong market positions in new risk areas.

Connect with Insurtechs – Partnering with Insurtechs will allow traditional insurers to capitalize on their expertise in niche markets and specialized insurance areas, expanding their product offerings and reaching untapped customer segments. Additionally, this collaboration would enable insurance companies to experiment with innovative business models and distribution channels, ensuring agility in adapting to changing market demands and seizing growth opportunities.

Conclusion

The insurance sector’s way forward hinges on skillfully integrating technology, cultivating customer interactions, nurturing confidence, harnessing data insights, and pioneering novel products. By embracing these approaches, insurers can successfully navigate the ongoing quest for customer loyalty, establish growth and maintain their pivotal role in shielding both individuals and enterprises from unexpected uncertainties.